With ₹24,500 crore in cash reserves, the company is set to consider a fresh buyback, its first in three years.

Shares of Infosys were down 1.08% at ₹1,516 in early trade on Thursday, ahead of a board meeting to consider a share buyback.

In a press release on September 8, Infosys announced that a board meeting will be held on Thursday to consider a proposal for a share buyback, its fifth in the last eight years and the first in three years.

Some reports suggest that Infosys will opt for the tender offer method over the open market route to buy back the shares. In a tender offer, the company proposes to repurchase shares from existing shareholders at a fixed price, typically set at a premium over the market rate. Shareholders then have the option to tender their shares within a defined window.

Infosys has approximately ₹24,500 crore in cash on its balance sheet as of June 2025.

Brokerage View

Morgan Stanley noted that the timing of the buyback is noteworthy given the current macroeconomic uncertainty. It expects the buyback size to fall between ₹10,000 crore and ₹14,000 crore.

Historically, Infosys has offered a buyback price at a premium of 18% to 25% over the previous day’s closing price.

Stock Watch

Infosys’ stock reacted positively to the announcement, gaining nearly 7%. Prior to this, the stock had declined for five consecutive sessions, losing 4.4%.

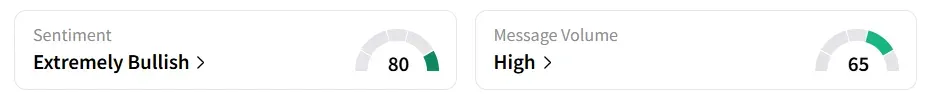

Retail sentiment shifted to ‘extremely bullish’ on Stocktwits, having been ‘bearish’ last week. Market chatter has been ‘high’ over the last couple of sessions.

Year-to-date, the stock has shed nearly a fifth of its value.

Nifty IT was down 0.6% in early trade, having gained 5.6% over the past couple of sessions.

For updates and corrections, email newsroom[at]stocktwits[dot]com.<