- ₹18,000 crore buyback point to strong fundamentals and investor trust.

- Promoters opting out of the buyback may improve retail entitlement ratios.

- Technical charts hint at a possible bullish breakout if key resistance levels are crossed.

Infosys, India’s second-largest IT services company, has announced its biggest share buyback proposal to date. Infosys’ shares have gained 5% this week ahead of its ₹18,000 crore buyback. The record date has not been announced yet.

Infosys Buyback Details

Infosys plans to repurchase up to 10 crore equity shares at ₹1,800 each, representing 2.41% of its total paid-up equity. Founders and promoters, including Narayana Murthy, Sudha Murty, and Nandan Nilekan,i have chosen not to participate.

SEBI-registered analyst A&Y Market Research noted that this move reflected a vote of confidence in the company’s long-term growth. This increases the entitlement ratio for retail investors, giving them a better chance to benefit from the buyback premium.

During a share buyback, a company purchases its own shares back from existing shareholders.

What This Means For Investors

A&Y Market Research said this sparks a positive short-term sentiment as the buyback and promoter opt-out signal strong fundamentals and shareholder-friendly policies.

Over the long term, promoters retaining their stake suggests confidence in future growth, especially in a competitive IT services landscape. With promoters stepping aside, retail investors may see better participation in the buyback, potentially locking in gains at a premium.

Infosys: Technical Outlook

Infosys stock is currently trading rangebound and has faced rejection near the ₹1,539 resistance level.

They identified next resistance at ₹1,632 (double bottom neckline), with support at ₹1,427. A breakout above ₹1,539 could open the path to ₹1,632, and if the stock crosses ₹1,632, it may signal a trend reversal with further upside potential.

A&Y Market Research advised investors to closely watch the price action around these levels, consider buying on a breakout above ₹1,539 with a target of ₹1,632, and stay prepared for a possible shift in trend should the price move beyond ₹1,632.

What Is The Retail Mood On Stocktwits?

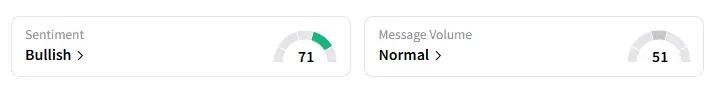

Data on Stocktwits showed that retail sentiment has stayed ‘bullish’ since its Q2 earnings report earlier this month.

Infosys’ shares have declined 19% year-to-date (YTD).

For updates and corrections, email newsroom[at]stocktwits[dot]com.<