India rolled out GST 2.0 in September 2025, simplifying tax slabs, reducing rates on essentials, empowering MSMEs, boosting middle-class disposable income, and stimulating consumption.

By Vineeta H, Kerala State Economic Cell Convenor, BJP: India stands at the threshold of a historic economic transformation with the rollout of Next Generation GST reforms in September 2025. As the country ushers in GST 2.0, the government’s clear and ambitious objectives are more visible than ever: to simplify the tax regime, reduce compliance burdens, stimulate consumption and growth, and empower broad swathes of society, from MSMEs to women, youth, farmers and middle class.

The Broader Vision: Goals of GST Reforms 2025

The primary objectives of the 2025 GST reforms include:

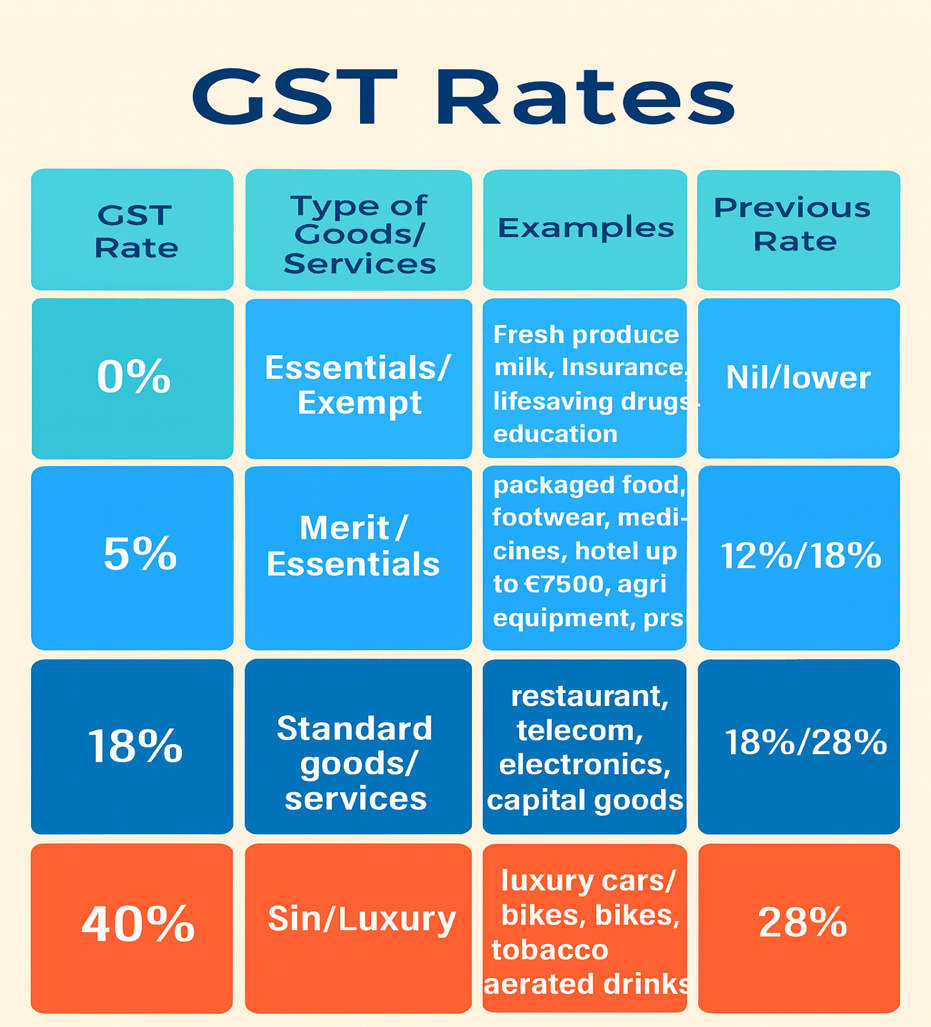

- Streamlining India’s tax infrastructure by moving from a multi-layered structure to a simplified two-slab system (5% and 18%), with a targeted 40% for luxury and sin goods.

- Fix inverted duty structures and move most goods from the old 12% and 28% slabs to lower rates, making the tax code easier to follow and eliminating classification disputes.

- Provide direct relief to consumers by lowering rates on essentials and high-consumption goods, thus increasing disposable income and stimulating demand.

- Empowering MSMEs and small businesses by ensuring easier compliance, digital processes, and quicker refunds, thereby improving cash flow and expanding opportunities in the formal economy.

- Boosting industry competitiveness, formalization, and job creation, especially in labor-intensive sectors, while maintaining fiscal stability and transparency.

- Strengthening state and Central government revenues, ensuring funds for essential public programmes and nation-building.

- Modernizing systems, encourage formalization, and leverage GST as a tool for inclusive growth and policy effectiveness, not just revenue generation.

From Fragmentation to Clarity: Legacy and Evolution

Before the introduction of GST in 2017, the tax environment was chaotic, cascading indirect taxes like VAT, excise, service tax, and entry levies have stymied the commerce and raised prices for both businesses and consumers. The GST Council, an unique federal and state integrated mechanism, transformed this, delivering a single, tech-enabled national tax regime with compliance rates soaring to over 93% and monthly revenues exceeding ₹1.8 lakh crore.

The 2025 Overhaul: What Has Changed?

GST 2.0 consolidates the previous five slab system (0%, 3%, 5%, 12%, 18%, 28%) into three major tiers: 0%, 5%, 18%, with a 40% bracket for luxury and demerit goods. Nearly all daily-use, agricultural, and essential products now attract 0% or 5% GST, while close to 90% of goods from the high 28% rate are downshifted to 18%.

India’s New GST Slabs (2025) vs the Old

Empowering MSMEs: The Growth Engine Fired Up

For India’s small businesses and MSMEs, the reforms are transformative and some of the key benefits include:

- Lower rates on inputs (textiles, cement, machinery) and correction of inverted duty structures would reduce the cost, improve working capital, and support competitive pricing.

- Fast-tracked registration, digital compliance, and system-driven refunds remove red tape, encourage formalization, and provide much-needed liquidity, fueling expansion and job creation.

Public Impact: Targeted Relief and Social Progress

Farmers benefit from cheaper machinery and equipment, while women gain from lower taxes on sanitary products and healthcare essentials. The reduced burden on food, medicines, and daily-use items gives immediate relief to all citizen classes.

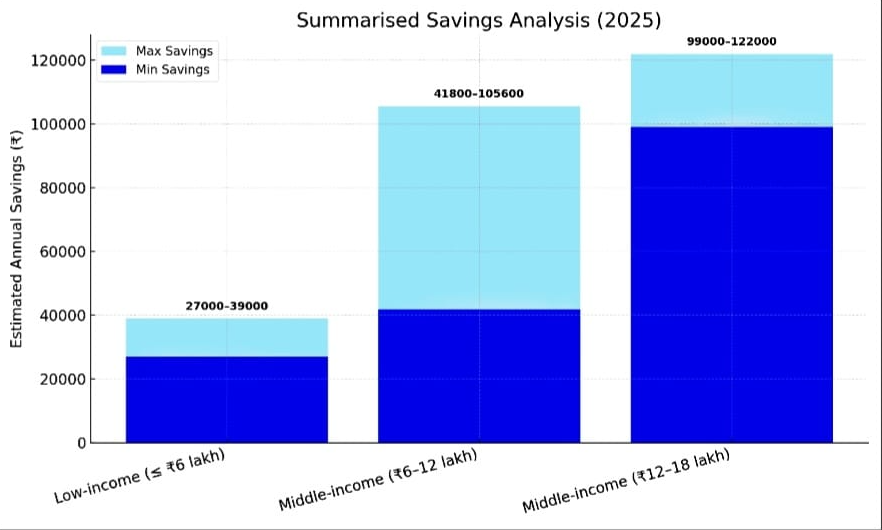

Double Bonanza: Income Tax Reform

The 2025 income tax and GST reforms are set to significantly ease financial pressures for economically weaker sections, low and middle-income households. Families earning up to ₹6 lakh annually will see complete income tax exemption, saving about ₹23,000–₹31,000, along with ₹4,000–₹8,000 in GST relief, totaling up to ₹39,000 a year. Middle-income households, particularly those between ₹6–18 lakh, stand to benefit even more, with income tax savings ranging from ₹33,800 to over ₹1 lakh and GST savings of ₹8,000–₹20,000. In total, these reforms could put an additional ₹41,800 to ₹1.22 lakh in the hands of middle-class families annually, boosting disposable income and consumption.

Unlocking Growth and Consumption

Experts estimate the combined reforms will infuse ₹2–2.5 lakh crore in additional liquidity annually. This is expected to stimulate demand for manufactured goods and services, supporting GDP growth by 0.6%–0.9% over the coming fiscal period.

A Global Benchmark

With a new GST structure rivalling the best in South and Southeast Asia, and an equitable, progressive tax regime, India now finds itself in a stronger position to attract investment, foster innovation, and promote inclusive prosperity.

An Abundant Diwali

As families prepare for Diwali 2025, there is tangible hope on the horizon. The GST 2.0 reforms, anchored in clear objectives of simplification, inclusiveness, and growth, offer the promise of fuller wallets, a competitive MSME sector, empowered farmers, women, youth and a future where the entire nation has reason to celebrate and spend with optimism.

Disclaimer: The opinions expressed are solely those of the author and do not reflect the views or stance of the organization. The organization assumes no responsibility for the content shared.