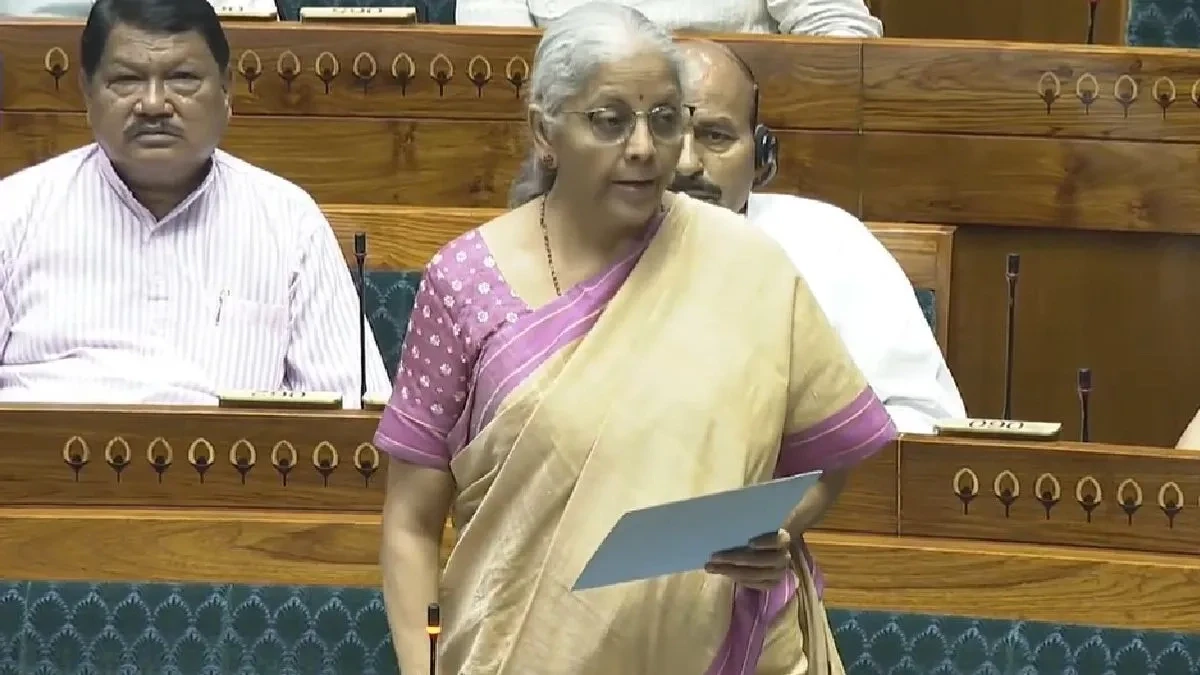

On Monday, the Lok Sabha passed the Income Tax (No. 2) Bill, 2025 without debate, just hours after it was introduced by Finance Minister Nirmala Sitharaman.

The bill, tabled on Monday afternoon, came days after the government withdrew the earlier Income Tax Bill, 2025 from the House on Friday.

This revised legislation incorporates nearly all the recommendations made by the 31-member Select Committee, headed by BJP MP Baijayant Panda, which had examined the earlier draft. The move follows the government’s July 2024 budget announcement of a time-bound, comprehensive review of the Income-tax Act, 1961, aimed at making it concise, lucid, and easier to interpret.

The passage occurred amid ongoing opposition protests demanding a debate on the Special Intensive Revision (SIR) of electoral rolls in Bihar, which have caused repeated disruptions in both Houses since the start of the monsoon session.

Originally introduced on February 13, 2025, the first version of the Income Tax Bill was referred to the Select Committee. The panel presented its 4,584-page report to the Lok Sabha on July 21, 2025, making 566 suggestions to tighten definitions, remove ambiguities, and align the new law with existing legal frameworks. The recommendations also reflected stakeholder input to ensure accuracy in legal meaning.

Key Recommendations and Legislative Overhaul

Key changes proposed by the committee included allowing refunds even if income tax returns are filed after the due date, aligning the definition of micro and small enterprises with the MSME Act, and clarifying provisions for non-profit organisations regarding ‘income’ vs ‘receipts’, anonymous donations, and the removal of the deemed application concept. The panel also sought clearer provisions on advance ruling fees, TDS on provident funds, low-tax certificates, and penalty powers.

The government cited drafting corrections, alignment of phrases, consequential changes, and improved cross-referencing as reasons for replacing the earlier bill. The new law will replace the 64-year-old Income-tax Act, 1961, which has been heavily amended over the decades, making it overly complex and burdensome for taxpayers and administrators.

The House also passed the Taxation Laws (Amendment) Bill, 2025 without debate.