Benchmarks closed lower for the fourth straight session, with Nifty slipping below 25,100 and Sensex under 82,000

Indian equity markets ended lower for the fourth consecutive session with the Nifty slipping below 25,100 and the Sensex closing below 82,000. The sell-off was led by real estate and auto stocks. FMCG was the only sector to end in the green.

On Wednesday, the Sensex closed 386 points lower at 81,715, while the Nifty 50 ended down 112 points at 25,056. Broader markets saw selling pressure, with the Nifty Midcap index ending 1% lower and the Smallcap index falling 0.6%.

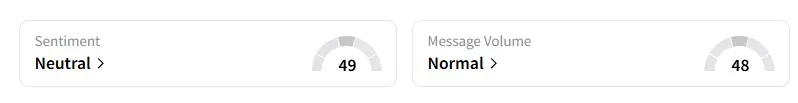

The retail investor sentiment surrounding the Nifty 50 moved from ‘bearish’ to ‘neutral’ by market close on Stocktwits.

Stock Moves

Swiggy shares ended over 2% lower after its board approved exit from Rapido via stake sale to Prosus and Westbridge.

Bajaj Electricals saw its biggest intraday gain since May after it announced the acquisition of Morphy Richards. It ended 1% higher.

Tata Investment shares jumped over 20% in two days after announcing a 1:10 stock split with October 14 set as the record date. Investors are also watching the upcoming IPO from Tata Capital.

Minda Corp shares ended 8% higher as the company revealed its Vision 2030 plan, aiming to triple revenues and boost margins through major capex and new products. While Kaynes Technology rose 3% after appointing a new managing director.

SCI ended 4% higher and GRSE gained 2% as the Union Cabinet approved a ₹69,725 crore plan for the shipbuilding and maritime sector.

Adani Group companies saw profit booking with Adani Power ending 10% lower.

Markets: What Next?

Globally, European markets traded lower, while US stock futures indicate a cautious start on Wall Street.

For updates and corrections, email newsroom[at]stocktwits[dot]com. <