Nifty ended below the 25,400 mark, breaking a three-day winning streak. Analysts see bullish undertones as long as it holds above 25,200.

Indian equity markets snapped a three-day gaining streak, with the Nifty index failing to hold the 25,400 mark. For the week, however, benchmark indices have clocked in nearly 1% gains.

On Friday, the Sensex closed 387 points lower at 82,626, while the Nifty 50 ended down 96 points at 25,327. Broader markets held minor gains, with the Nifty Midcap index ending flat and the Smallcap index gaining 0.1%.

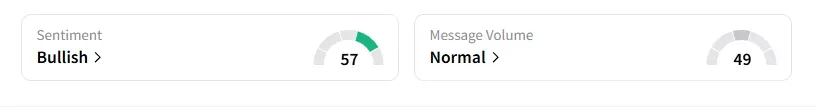

The retail investor sentiment surrounding the Nifty 50 moved to ‘bullish’ by market close on Stocktwits.

Stock Moves

Sectorally, PSU banks, metals and pharmaceuticals saw strong buying. On the other hand, consumer durables, FMCG and technology saw selling pressure.

Adani Group stocks rallied after the Securities and Exchange Board of India (SEBI) gave a clean chit to the Adani Group in a high-profile case triggered by US-based short-seller Hindenburg Research. Adani Power ended 14% higher following Morgan Stanley’s bullish note and as it was the last day to buy shares to be eligible for the upcoming stock split. Adani Ports gained 2%, while Adani Enterprises rose 5%.

Vodafone Idea shares ended 8% higher after the Supreme Court deferred the AGR case hearing to next week as the Centre sought more time, saying that a ‘solution is required’ soon.

Kaynes Technology recovered to end 1% lower after its chief executive officer resigned, but the company clarified in a media interview that a replacement candidate has been identified and will be announced soon.

Redington, a distributor of Apple products in India, closed 3% higher, following the launch of the iPhone 17 series.

Stock Calls

Mayank Singh Chandel said BSE has been in a steady uptrend since 2020, with only a few pullbacks along the way, demonstrating its overall bullish strength. On the daily chart, the stock had been falling since June 2025, but the decline paused near the earlier resistance-turned-support zone and the 200-day EMA, around ₹2,070–₹2,000, which suggested that buyers are active at these levels.

He recommended traders wait for a clear close above the falling trendline shown in the chart before making fresh enteries, and maintain a stop-loss below ₹2,000. It’s best to trail your target using swing lows to lock in profits as the move unfolds, he added.

Gaurav Narendra Puri is bullish on Exide, with a stop los at ₹414 and target prices at ₹428, ₹435, and ₹440 for a holding period of two to three weeks. This call is backed by strong technical indicators, a flag pattern breakout and solid fundamentals.

Palak Jain is bullish on Inox Green. She recommended buying above ₹183, with a stop loss at ₹164 for target prices of ₹187, ₹193, and ₹204. The stock has seen an inverse head and shoulder breakout above significant resistance confirmed with rising volumes and sustained weekly momentum.

Markets: What Next?

Analyst Shubham Jain said that a confirmation above yesterday’s high could trigger a new rally.

Ashish Kyal noted that Nifty was consolidating in a range and for an uptrend to resume, it needs to break above 25,430. The Gann level of 25,361 is acting as a pause in momentum for a day or two. On the downside, short-term support is seen at 25,250.

Analyst Sunil Kotak highlighted that the index was seeing retracement between 25,200 to 25,250. As long as the index remains above the 25,200 level, the outlook stays bullish. A strong supply zone lies between 25,500 and 25,550, which may come into play in the coming days. He suggested keeping AMC and NBFC stocks on the watchlist.

Globally, European markets traded mixed, while US stock futures indicate a subdued start on Wall Street.

For updates and corrections, email newsroom[at]stocktwits[dot]com. <