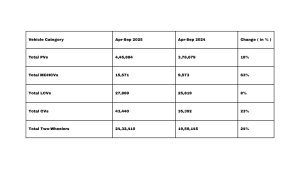

New Delhi: India’s automobile industry has seen mixed performance in the first half of FY2026. Between April and September 2025, domestic vehicle sales stood at 1.31,45,677 units, showing only 0.6% growth over last year. However, exports of vehicles from the market rose significantly, with 24% year-on-year to 3.14 million units.

Including all major segments, along with passenger vehicles, two-wheelers, commercial vehicles, and three-wheelers, have recorded strong export growth. At the halfway point of FY2026, India Auto showed up as the best ever export for a fiscal year. FY2025 India Auto Inc has already achieved 59% of last year’s total exports (5.36 million units) and is on track to set a new record, surpassing FY2022’s 5.61 million units.

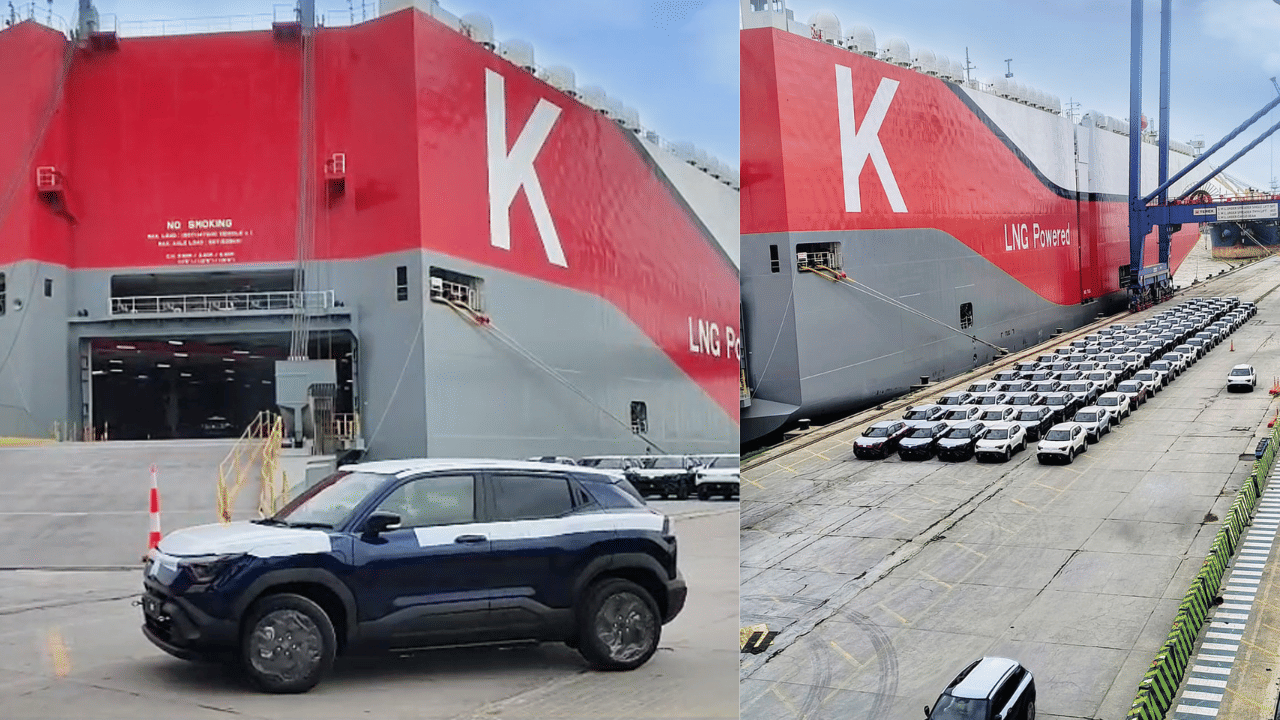

Passenger Vehicles:

Passenger vehicle exports rose 18% to 4.46 lakh units in the first half. Cars made up 2.29 lakh units (up 12%), SUVs and MPVs 2.11 lakh units (up 26%), and vans 5,230 units (up 37%). Maruti Suzuki continues to dominate exports with 2.05 lakh units shipped, marking 40% growth and covering 62% of last year’s total. The company aims to export 4 lakh units in FY2026, helped by the new e-Vitara EV made in India. Hyundai follows with 99,540 units, up 17% year-on-year.

Two-Wheelers:

Two-wheeler exports touched 2.4 million units, up 21% from last year, accounting for nearly 60% of FY2025’s total. Motorcycles led the charge with 2.09 million units, up 28%. Bajaj Auto topped the list, exporting 8.9 lakh bikes and 210 e-scooters (up 17%). TVS Motor grew 35% to 6.8 lakh units, while Honda exported 3.1 lakh units (up 12%). Hero MotoCorp showed strong momentum with 1.76 lakh units (up 54%). Yamaha (1.71 lakh units) and Suzuki (70,000 units) also posted healthy growth.

Commercial Vehicles:

Exports of commercial vehicles grew 23% to 43,440 units. Light CVs made up most of it with 27,869 units (up 8%), while medium and heavy CVs rose sharply by 63% to 15,571 units. Mahindra & Mahindra led with 8,860 units, followed by Ashok Leyland with 7,795 units (up 38%). Isuzu saw a 21% drop to 7,459 units.

According to Dr Pawan Goenka, former M&M MD, Indian automakers now need to focus strongly on global markets. He said that if the domestic car market grows 10-12%, exports must grow by at least 20% to sustain the momentum.

By Ahsan Khan