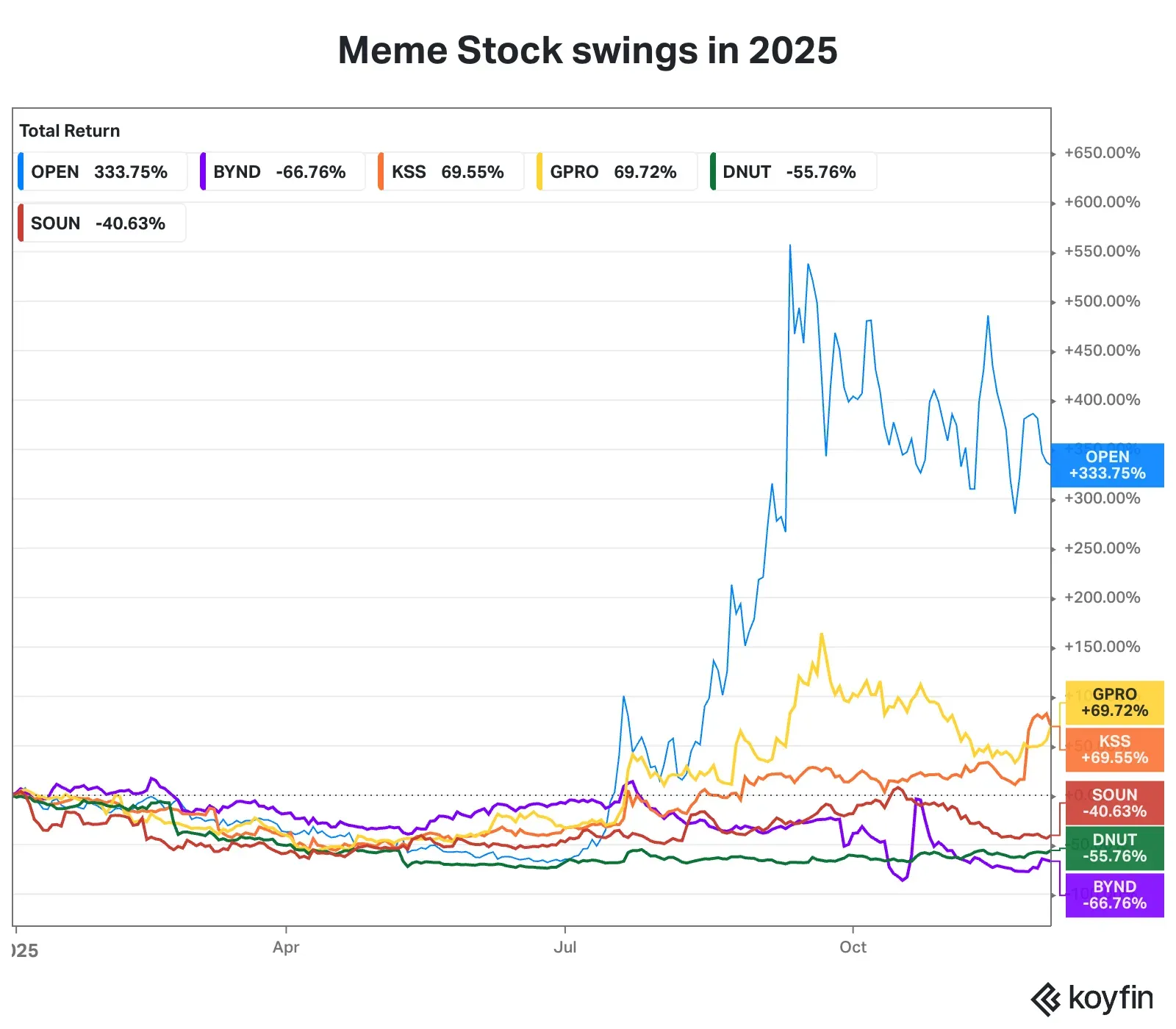

Here’s a look at what drove the moves and which meme stocks investors might watch for 2026.

- Opendoor and GoPro gained sharply, emerging as the top meme stocks in a year that saw muted activity in original names like GME and AMC.

- Beyond Meat, SoundHound, and Kohl’s also saw sharp swings, driven in part by fundamental factors.

- Some analysts say the rally in meme stocks and their appeal are waning.

This year turned out to be a mixed bag for meme stocks — the real action didn’t kick in until the second half of 2025, and some traders argue the hype around the category is cooling.

A new crop of names — Opendoor, GoPro, Kohl’s, SoundHound, Krispy Kreme, and Beyond Meat — delivered wild swings, overshadowing the original group comprising GameStop, AMC Entertainment, and BlackBerry.

In fact, meme stock favourite GameStock was a bust, as its chief hype-driver, Keith Gill a.k.a. “Roaring Kitty,” was virtually absent this year. Some retail investors still expect potential fireworks toward the end of December, as the company gears up to report quarterly earnings next week.

Opendoor is arguably the biggest winner of the year – the stock went from $0.50 at the start of July to a lifetime high of $10.50 in late September. That’s impressive, but not as much as GameStop’s Roaring Kitty-fueled rally (about 1,800% jump in 10 days) back in 2021.

In fact, S3 Partners, a prominent stock analytics firm, has said that meme stocks are dead and investors should instead look at “battleground stocks,” a term it uses for high-stakes institutional battles.

Using Kohl’s as an example, S3 said it surged by more than 30% intraday in July, not because of retail hype but because of $50 billion in institutional hedge-fund positions.

Here’s a look at what drove the moves and which meme stocks investors might watch for 2026.

Opendoor

Although OPEN has pulled back a bit lately, its 333% year-to-date gain shows the hype is still very much alive. In July, Canadian hedge fund manager Eric Jackson jumped in as a vocal supporter, issuing eye-popping price targets and arguing that the online real estate platform could mirror the explosive gains seen in Carvana, the early pioneer of online car sales.

That sparked a sharp rally, which was further amplified as other high-profile voices, including crypto investor and podcaster Anthony Pompliano, piled on the hype. Opendoor also drew fresh attention with the return of its founders to the board, a new CEO hire from Shopify, and frequent management posts on X touting AI, tokenization, and other growth initiatives. The company even issued special warrants to keep retail investors engaged.

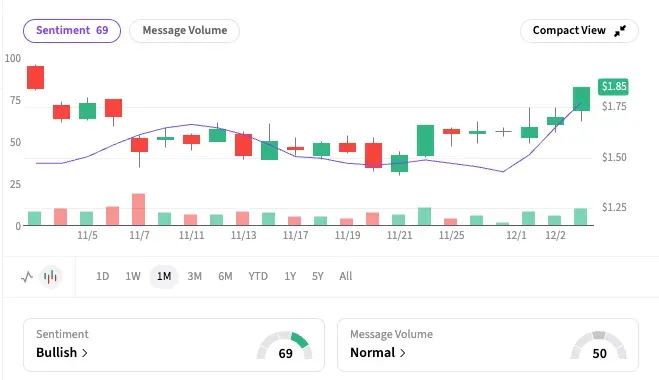

Stocktwits sentiment for OPEN has dropped over the past month to ‘extremely bearish,’ while message volume has soared by over 736% in the past year.

GoPro

Despite its global brand recall and cutting-edge action cameras, GoPro’s business has suffered over the last few years. Chinese rivals like Insta360 have flooded the market with cheaper alternatives, while consumers have increasingly shifted to ever more powerful smartphone cameras. GoPro has tried pushing subscriptions and services, but that hasn’t scaled quickly enough to offset the slide in camera sales.

GPRO saw two spikes. In June, the company won a favourable ruling in a copyright infringement case against Insta360, sending the stock up 200% in just four days and landing it on investors’ meme-stock radar. Then, in August, the company launched a major growth initiative: licensing its terabytes of video feed for AI model training. The market initially missed the announcement, which was made during an earnings report, but it later caused the stock to rally sharply.

Stocktwits sentiment for GPRO has risen this week, and was ‘bullish’ as per the last reading, while message volume over the past year has rocketed by over 1,300%.

Kohl’s

The department store retail chain joined the meme-stock list, gaining more than 100% in just two days in July, with no fundamental trigger. During that period, the stock’s short interest was reportedly very high, leading to a short squeeze as the price rose.

Later, in November, the stock ripped more than 50% in just three days — this time fueled by a strong earnings report and optimism around the appointment of a new CEO. For the year, Kohl’s stock is heading for a strong close. It has gained about 64% to date, versus a 51% drop in 2024.

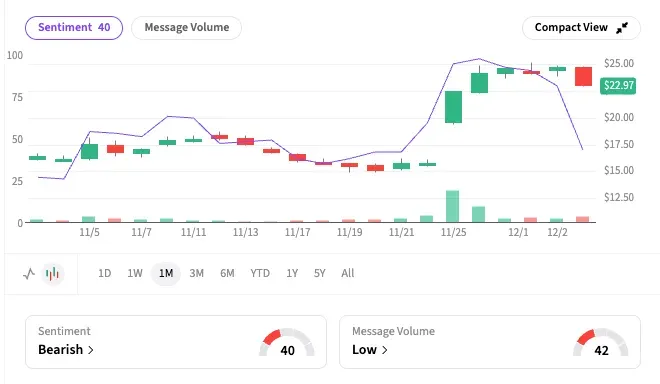

KSS’s Stocktwits sentiment rose around its earnings report on Nov. 27 and has since dipped to ‘bearish.’ Over the past year, message volume has nearly doubled, and the ticker has added 55% more watchers.

Beyond Meat

The faux meat company was an innovator and a stock market high-flyer when it went public in 2019. But its business, and consequently its stock, have been in decline due to weak sales, losses, and declining consumer demand for highly processed plant-based meats.

In the back half of the year, the company underwent a flurry of restructuring moves that created a boom-and-bust cycle in the stock. Notably, Beyond Meat completed a debt-to-equity conversion in October, which massively diluted its shares and caused them to drop.

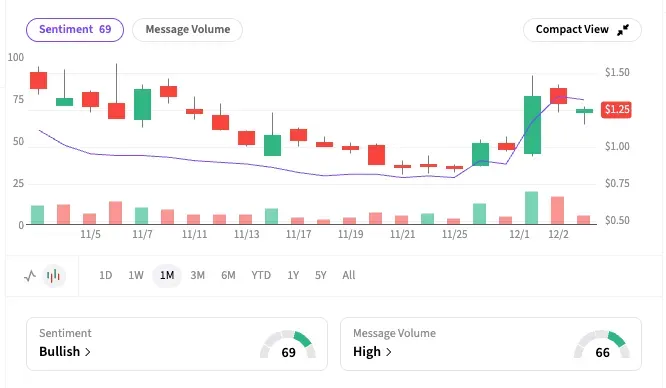

Over the month and in November, the company’s expanded partnership with Walmart and yet another weak quarterly report sent shares swinging widely. Cumulatively, BYND is down 67% year-to-date, and its most recent Stocktwits sentiment is ‘bearish’. Message volume over the past year has also been more than healthy, rising by over 1,870%, while follower count has jumped by more than 20%.

For updates and corrections, email newsroom[at]stocktwits[dot]com.<