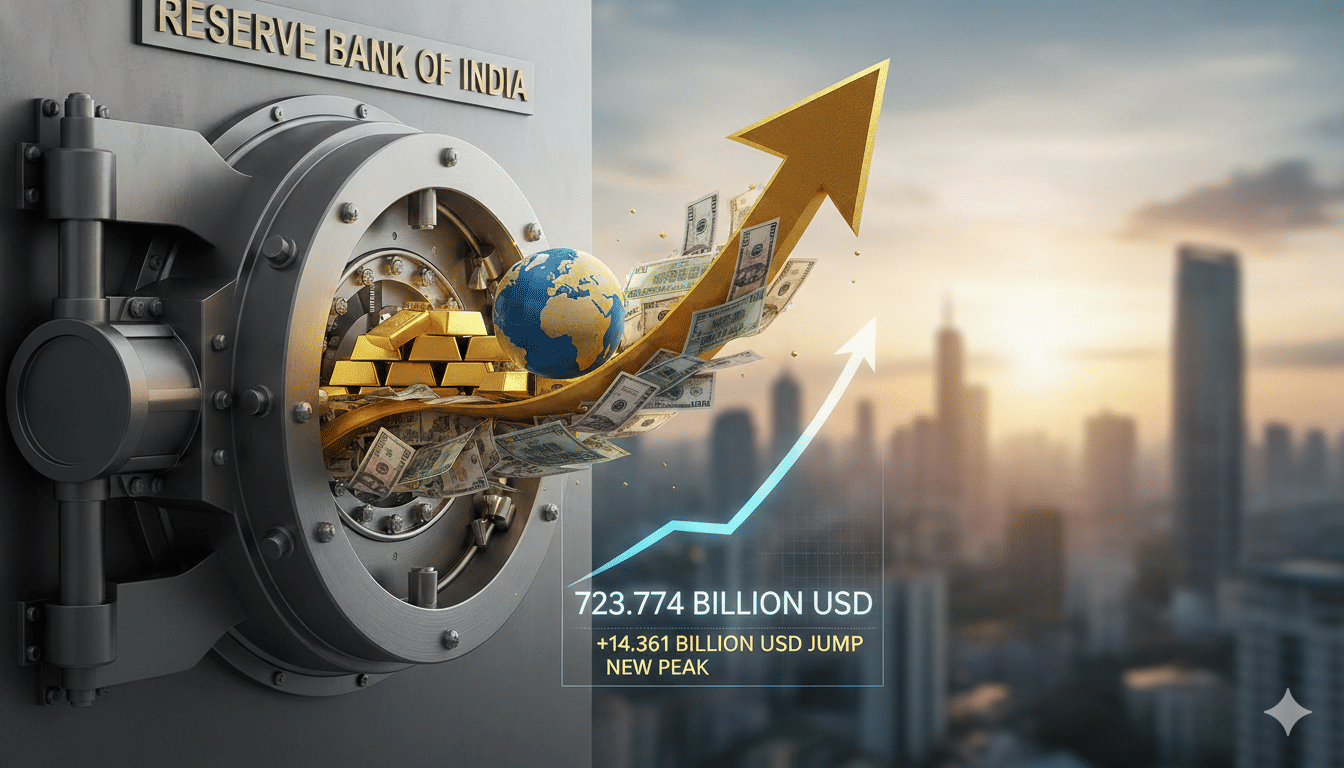

New Delhi: India’s foreign exchange reserves have once again scaled a fresh peak. According to the latest data from the Reserve Bank of India (RBI), USD 14.361 billion to a new all-time high of USD 723.774 billion during the week ended January 30. In the previous week, the reserves had surged by more than $8 billion, reaching $709.41 billion and surpassing the old record set in September 2024. The sharp rise over two consecutive weeks has further strengthened India’s external financial position.

India’s Gold reserves also jumped by USD 14.595 billion to USD 137.683 billion during the week, as per the data released by the RBI. The Special Drawing Rights (SDRs) surged by USD 216 million to USD 18.953 billion.

Why forex reserves jumped

The foreign exchange reserves soared due to strong jump increase in gold reserves. The strengthening of gold prices in international markets had a direct impact on India’s total reserves, giving strong support to the forex reserves. However, foreign currency assets (FCA), considered the largest component of forex reserves, recorded a marginal dip during this period.

According to the data, FCA went down by $493 million to $562.39 billion. The RBI said that FCA is calculated by considering the account fluctuations in the value of currencies such as the Japanese yen, pound, and euro, besides the US dollar, so increases or decreases in these currencies affect the overall figures.

Increase in Special Drawing Rights

Other international assets also showed positive changes. Special Drawing Rights (SDR) jumped by $216 million, reaching $18.95 billion. Meanwhile, India’s reserve position with the International Monetary Fund (IMF) also went up by $44 million to $4.74 billion, reflecting the country’s strong standing in global financial institutions.

A jump in forex reserves is a positive sign for India’s economy. Strong forex reserves helps in keeping Rupee and makes it easier to pay import bills, deal with global volatility, and maintain the confidence of foreign investors.