Telsey Advisory Group maintained its price target of $455 on Home Depot and $305 on Lowe’s.

Home Depot and Lowe’s Cos are set to report second-quarter results next week, with analysts and investors looking forward to commentary regarding home improvement demand trends improving over time, especially for large-scale projects.

Retail sentiment on Home Depot dipped to ‘neutral’ from ‘bullish’ territory, with chatter at ‘low’ levels, according to Stocktwits data. Shares of Home Depot were up nearly 2% during early trading on Wednesday.

“We anticipate home improvement demand trends improving over time, as consumers stop putting off projects despite high interest rates, eventually getting used to the rates as opposed to waiting for them to fall,” Telsey Advisory Group analyst Joseph Feldman said.

Telsey Advisory Group maintained its price target of $455 on Home Depot and kept its ‘outperform’ rating. Home Depot is expected to post net revenue of $45.43 billion in the second quarter and EPS of $4.70, according to data compiled by Fiscal AI.

Feldman added that Home Depot should remain a long-term winner in retail, given its digital prowess and hybrid work-from-home arrangements, causing more maintenance and repair activity.

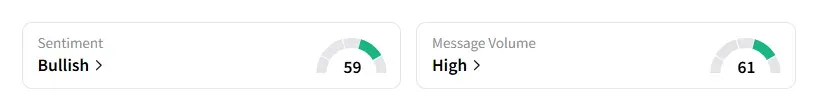

Retail sentiment on Lowe’s remained unchanged in the ‘bullish’ territory, with message volume at ‘high’ levels, according to Stocktwits data. Shares of Lowe’s were up 2.6% in morning trade.

Feldman noted that Lowe’s remains well-positioned to outperform the home improvement market thanks to benefits from its Total Home strategy, which is strengthening merchandising and space productivity through localization and private brands, as well as expanding the Pro business.

Telsey Advisory Group maintained its price target of $305 on Lowe’s and kept its ‘outperform’ rating. Lowe’s is expected to post net revenue of $23.99 billion in the second quarter and EPS of $4.25.

Home Depot stock has gained nearly 4% so far this year, while Lowe’s has risen almost 2% year-to-date.

For updates and corrections, email newsroom[at]stocktwits[dot]com.<