Analyst sees the stock breaking out of consolidation with targets up to ₹570.

Hindustan Zinc shares surged nearly 4% on Monday, driven by record rally in silver prices. Silver has hit an all-time high on MCX (₹1,40,000/kg).

Hindustan Zinc, being India’s largest silver producer, directly benefits from higher bullion prices. Also, the company is looking to double its production capacity to 2 million tonnes in 3–5 years, backed by a capex of ₹30,000–₹35,000 crore.

With vast reserves of 450 million tonnes of ore, future supply visibility looks strong, according to SEBI-registered analyst Finkhoz RoboAdvisory. They added that Hindustan Zinc is setting up for a breakout. With strong fundamentals, capex-led growth, and commodity tailwinds, the stock has the potential to shine again.

Technical Outlook

On the technical charts, Finkhoz said that the stock was showing strength after a long consolidation. Hindustan Zinc is trading above its 200-day moving average (DMA) of ₹450, a key support zone. Technical indicators such as the Relative Strength Index is holding near 57, showing momentum is still intact.

On the upside, they identified strong resistance at ₹480–₹485, which, if breached, could pave the way to the next target of ₹560–₹570 (a previous swing high).

Trading Call: Swing to Medium-Term View

Finkhoz has identified a stop loss at ₹440-₹430, with an immediate target of ₹480, indicating a 5% upside and a medium-term target of ₹560 and higher (a potential 20% upside). They believe that if silver continues its rally, Hindustan Zinc could mirror that momentum and surprise on the upside.

What Is The Retail Mood?

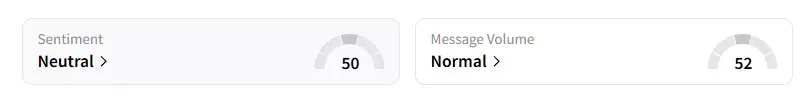

Data on Stocktwits shows that retail sentiment moved from ‘bullish’ last week to ‘neutral’ on this counter.

Hindustan Zinc shares have gained 5% year-to-date (YTD).

For updates and corrections, email newsroom[at]stocktwits[dot]com.<