- Hindalco shares have gained over 10% in a month, boosted by record aluminium prices

- Institutional investors back Hindalco, which is trading near breakout levels after a 36% YTD rally.

- Technical patterns suggest further upside, though fresh buyers may need to wait for a pullback.

Hindalco shares have been gaining attention this week, clocking another 3% on Friday as global aluminum prices hit record highs. Over the last month, Hindalco has rallied over 10%.

Aluminium prices on the London Metals Exchange (LME) crossed the mark of $2,850 per tonne. Other aluminium stocks such as National Aluminium (Nalco) and Vedanta also gained up to 4%.

SEBI-registered analyst Mayank Singh Chandel noted that the Aditya Birla Group-led metals company has a low debt-to-equity ratio of 0.49 and a strong ROCE of 14.4%. About 56% of the stock is held by institutional investors, which shows confidence in the company.

Hindalco also recently updated investors about its pending US$125 million acquisition of AluChem in the US. The US government shutdown delays the review, but analysts see it as a positive for the specialty alumina business.

Hindalco: Technical Check

Hindalco stock had earlier broken out from a rounding bottom pattern and then consolidated near the breakout zone. This setup still points to potential upside, according to Chandel.

Chandel said that if you already own Hindalco, there could be more room to grow. He advised traders to trail the stops to protect gains. For those looking to buy fresh, Chandel advised waiting for a pullback.

What Is The Retail Mood On Stocktwits?

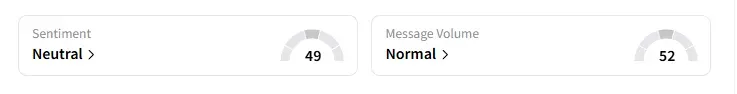

Data on Stocktwits showed that retail sentiment turned from ‘bearish’ to ‘neutral’ a day ago.

Hindalco shares have rallied 36% year-to-date (YTD).

For updates and corrections, email newsroom[at]stocktwits[dot]com.<