Momentum traders are advised to watch for short-term pullbacks, while medium-term trends remain bullish.

Metals stocks gained ground in Friday’s session, driven by positive global cues. Bets for a US Federal Reserve rate cut this month are rising and the European Union is planning to raise tariffs on steel imports.

Hindalco shares rose 2%, adding to the 6% rally this month following strong global metal pricing. On the technicals, the stock is trading around its recent yearly highs.

Technical Outlook

SEBI-registered analyst Deepak Pal noted that Hindalco stock was consistently above all major moving averages (MA20, MA50, MA100, MA200), indicating bullish momentum and strong trend continuation. Other technical indicators such as the parabolic SAR dots and MACD confirmed momentum strength.

Its Relative Strength Index (RSI) stood near 69, close to overbought territory, which indicates strong buying but warranted some caution for short-term entries. Pal added that sectoral tailwinds (metals rally, lower US rates, GST reform) and easing global pressures are favorable for Hindalco.

Going ahead, positive analyst triggers in the near-term can push Hindalco to new highs. Pal advised momentum traders to watch for brief consolidation or pullback due to high RSI, but the medium-term trend remains bullish.

Triggers To Watch

Hindalco’s Q2 FY26 results and investor call is scheduled for November 7. Analysts expect strong growth in both aluminium and copper verticals. The company started local lithium-ion battery foil production in October 2025, reducing import dependence and boosting future margins.

Additionally, Novelis’ expansion and new funding announcements, along with India’s broader manufacturing revival, may further elevate sentiment. Pal cautioned that any global commodity shocks or regulatory news should be monitored, but at present, the impact skew remains positive.

What Is The Retail Mood?

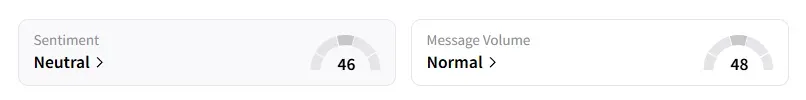

Data on Stocktwits shows that retail sentiment has been ‘neutral’ for a month. It was ‘bearish’ three months ago.

Hindalco shares have risen 30% year-to-date.

For updates and corrections, email newsroom[at]stocktwits[dot]com.<