Vascon Engineers rallied 13% on an Adani deal, while Azad Engineering gained on the back of a fresh long-term contract with Mitsubishi.

Two engineering stocks have gained investors attention on Monday on the back of significant order wins. Vascon Engineers rallied near its 52-week high after the company inked a pact with Adani Infrastructure, while Azad Engineering had signed a contract with a Japanese company.

Vascon-Adani Deal Sparks Rally

Vascon Engineers’ stock surged nearly 13% intraday in early trade after signing a Memorandum of Understanding (MoU) with Adani Infra, a subsidiary of the Adani Group. This partnership is set to expand Vascon’s project portfolio, particularly involving infrastructure projects in Mumbai, and is expected to boost the company’s annual turnover by 30%.

The collaboration will cover an estimated 13.15 million square feet of development across three identified projects in Mumbai, with Vascon handling work from the design stage through execution.

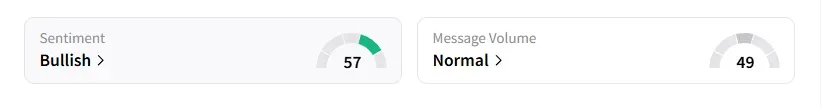

Data on Stocktwits shows that retail sentiment has turned ‘bullish’ a day ago on this counter.

Vascon Engineers has shown a notable uptick over the past month, with its shares gaining nearly 30%. For the year so far, it is up 20%.

International Contract Win Boosts Azad Engineering

Azad Engineering rose nearly 3% on Monday after securing a long-term contract and pricing agreement with Japan’s Mitsubishi Heavy Industries (MHI), valued at $73.47 million (approximately ₹651 crore), to be executed over five years.

This contract involves supplying highly engineered rotating and stationary airfoils for advanced gas and thermal power turbine engines, supporting MHI’s global power generation business. This latest deal builds upon an earlier agreement signed in November 2024, increasing the total contract value between the two companies to $156.36 million (approximately ₹1,387 crore).

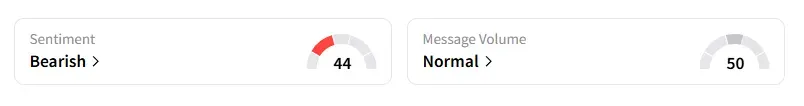

However, data on Stocktwits shows that retail sentiment has been ‘bearish’ for a week on this counter.

Azad Engineering shares have declined 7% year-to-date (YTD).

For updates and corrections, email newsroom[at]stocktwits[dot]com.<