New Delhi: Even after 79 years of independence, the journey of financial independence of women in the country is not completely over. However, now the idea of moving beyond traditional ways of saving and fulfilling their dreams through investment is growing rapidly among women. To further this thought, HDFC Mutual Fund has launched the fifth edition of its flagship campaign ‘BarniSeAzadi’. The aim of this initiative is to make women understand that true financial freedom is not achieved only by saving money, but by investing it properly. HDFC AMC MD and CEO Navneet Munot said, “This campaign has now become a social movement, which is moving towards financially empowering women.”

Stories that broke Barani’s thinking

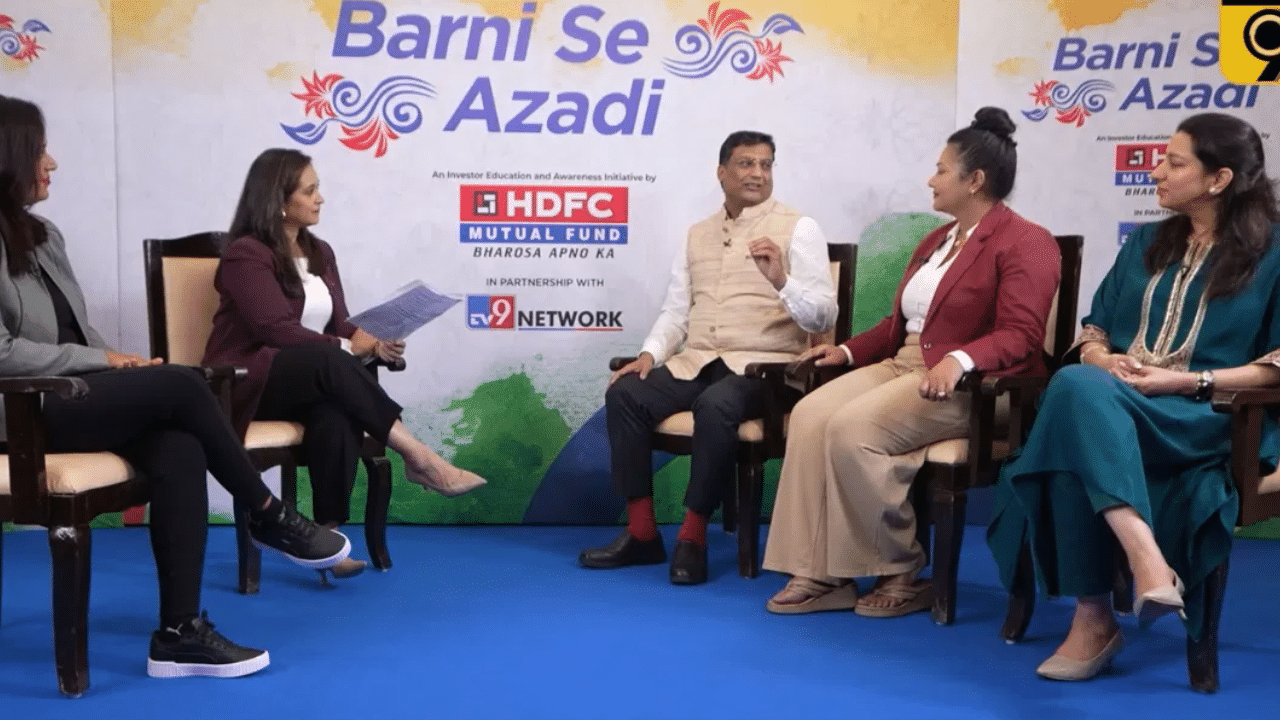

In this series, Money9Live organized a special discussion in which three such inspirational women participated, who not only broke the old thinking like ‘Barni’ in their lives, but also contributed to making other women financially independent. In this discussion, along with Navneet Munot, MD of Tatvik Ayurveda Rimjhim Sakia, Founder of Disha Clothing Disha Garg and Founder of 11:11 Slimming World Pratibha Sharma were present.

The spirit of new India in the eyes of women

At the beginning of the conversation, Navneet Munot shed light on the changing India. She said, “There has been a lot of change between India 30-35 years ago and today. Today you see hope, ambition and the passion to do something big in the eyes of women.” Sharing her 30 years of experience, she told that women have always been experts in saving. Earlier, the money saved from the monthly expenses was kept hidden in the jarni, cupboard or even under the sofa, so that it could be useful for the family when needed. But now times have changed, the same women have understood that money can also be increased by investing these savings.

Rimjhim Saikia- An example of change

Rimjhim Sakia, MD of Tatvik Ayurveda and Wellness Limited, said that she was doing a comfortable job in the corporate sector for a long time, but she felt that she should do something that brings change in the society. With this thought, she started Tatvik Ayurveda, under which she makes 22 types of products. The special thing is that 90% of the employees in her factory are women.

Disha Garg- From Housewife to Entrepreneur

The story of Disha Garg, the founder of Disha Clothing, is also inspiring. After graduating from NIFT, she could not start her career due to responsibilities. After playing the role of a housewife for 10 years, she opened her own boutique center and gave a new direction to her dreams.

Pratibha Sharma- Turning difficulties into opportunities

11:11 Slimming World founder Pratibha Sharma also gave an example of turning her challenges into opportunities. She says that till now she has served more than 1000 clients and has brought a positive change in their lives. She told how her mother played an important role in inculcating this habit of saving in her.

This is the identity of emerging India

After listening to these stories, Navneet Munot said, “This is the identity of emerging India. With time, if women also walk shoulder to shoulder with men in financial matters, then the picture will be even more interesting.”

The path to freedom through investment

When Rimjhim Sakia asked how she ensures an independent future for the women she supports financially, Munot said that awareness and guidance in the right direction is most important. He says, “This is the purpose of our campaign – ‘Azadi from Barni’. It is our job to invest women’s savings in the right direction. Today, if someone invests money in the capital market, it will grow over time. For this, SIP can be started with a minimum amount, but for this it is necessary to take the advice of a financial advisor.”

The right investment formula

Munot believes that women need to be more aware and updated in financial decisions. According to him, “The formula for making big money is- right investment, patience and long term thinking. Women have patience and the ability to think long term, if investment is added to this, the results will be excellent.” He also said that the change is not limited to cities only, women in rural areas have also started adopting investment now.

“It’s how much money you make that matters”

At the end of the conversation, Munot gave a message to all the women saying, “No path is difficult for today’s women. Women are participating enthusiastically in all fields from media to other fields. It does not matter how much wealth you have, it is more important how much money your money earns. That is why, just saving is not enough, but it is also important to be a good investor.”