Sustained strength above ₹1,580 could open the path toward ₹1,650, while weak guidance may lead to a pullback to ₹1,420, the analyst said.

HCL Technologies shares declined 1% on Monday ahead of its post-market September quarter (Q2 FY26) earnings report. After TCS, this will be the second major IT company to declare its earnings.

The street estimates steady sequential growth and will be closely monitoring the impact of H1-B visa fees, deal wins, and commentary on attrition and guidance.

SEBI-registered analyst Deepak Pal believes that on the technical front, the trend looks constructive with improving momentum. He added that if the Q2 FY26 results deliver on expectations, particularly with margin stability and deal pipeline strength, the stock could rally toward ₹1,600–₹1,650 levels. However, if results disappoint or guidance remains muted, a short-term correction toward ₹1,420–₹1,440 cannot be ruled out.

Technical Outlook

Pal noted that HCLTech has shown a noticeable improvement in its technical setup after forming a strong base near ₹1,400–₹1,420 levels. The stock has recently witnessed a breakout above its short-term moving averages (20-day & 50-day EMA), signaling a shift in momentum from consolidation to strength.

Its Relative Strength Index (RSI) has moved upward from the mid-zone, indicating renewed buying interest, while the MACD has given a positive crossover, further confirming bullish sentiment.

On the daily chart, prices are holding well above key support zones, suggesting that the stock may now enter a higher trading range. He pegged immediate resistance around ₹1,550–₹1,580, and a sustained close above this zone could open the path toward ₹1,620–₹1,650 in the near term for HCL Tech. On the downside, supports are seen near ₹1,440 and ₹1,400, where fresh accumulation is likely to emerge.

Trading Call

In the short term, Pal said that HCLTech appears poised for an upside move as technical indicators and price structure both hint at momentum building above ₹1,500. From a medium to long-term perspective (6–12 months), he believes that HCLTech remains fundamentally strong. Sustaining above ₹1,600 on a closing basis could open the next leg of the rally toward ₹1,750–₹1,850 levels, marking a potential trend reversal on higher time frames.

He concluded that the outlook remains constructive to bullish, with near-term volatility likely around the result announcement.

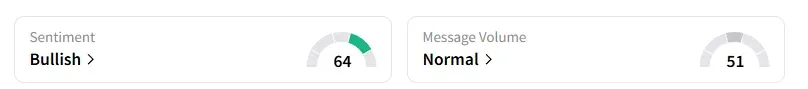

What Is The Retail Mood?

Data on Stocktwits shows that retail sentiment has been ‘bullish’ for a month on this counter.

HCL Tech shares have declined 23% year-to-date (YTD).

For updates and corrections, email newsroom[at]stocktwits[dot]com.<