Fractyl Health expects to file with the U.S. Food and Drug Administration for the approval of Revita in the second half of 2026.

Fractyl Health (GUTS) announced on Friday that patients who stopped taking the GLP-1 class drug Tirzepatide and were treated with its Revita lost an additional 2.5% of their total body weight at three months in a trial. At the time of writing, shares of the company traded 28% higher on Friday afternoon.

The study was designed to evaluate the Revita procedure in adults with obesity who achieved at least 15% total body weight loss with Tirzepatide, the active ingredient in Eli Lilly’s blockbuster weight loss drug Zepbound. Those who received a sham procedure after discontinuing Zepbound regained 10% total body weight in the study at three months, the company said.

Revita is Fractyl’s lead product candidate. The procedure is designed to reverse damage to intestinal nutrient-sensing and signaling mechanisms caused by chronic high-fat and high-sugar diets by remodeling the inner wall of the first part of the small intestine.

“These results are clinically and statistically significant and provide randomized, blinded evidence that drug-free, durable weight maintenance is possible,” the company said, while adding that the study also supports Revita in post-GLP-1 weight maintenance.

The company stated that no serious adverse events related to Revita were identified in the study, and side effects were infrequent and mild. The firm expects to file with the U.S. Food and Drug Administration for the approval of Revita in the second half of 2026.

On Friday, the company also announced the pricing of an underwritten offering of 60 million shares of its common stock at $1.00 per share, representing a discount of about 1% from the stock’s closing price on Thursday. The gross proceeds from the offering are expected to be about $60 million, the company added.

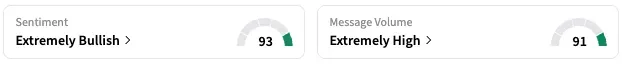

On Stocktwits, retail sentiment around GUTS stock rose from ‘bullish’ to ‘extremely bullish’ territory over the past 24 hours, while message volume rose from ‘high’ to ‘extremely high’ levels.

A Stocktwits user expressed disappointment at the offering.

GUTS stock is down 38% this year and by about 49% over the past 12 months.

Read also: Uber Reportedly Expects Non-Restaurant Deliveries To Surge Faster Than Previously Expected

For updates and corrections, email newsroom[at]stocktwits[dot]com.<