- Stock’s Biggest intraday percentage gain since March 2025

- Supply order awarded by IOC, BPCL, HPCL, and MRPL

- Stock remains bearish on weekly charts – analyst

Shares of Gulshan Polyols surged 15.7% to ₹164 on Thursday, after securing a major ethanol order.

It was the stock’s biggest intra-day gain since March.

₹1,184.86 crore Ethanol Supply Order

Gulshan Polyols secured a major ethanol supply order worth ₹1,184.86 crore for the Ethanol Supply Year (ESY) 2025 – 26, covering 175,652 kilo liters (KL). The order was awarded by leading oil marketing companies, including Indian Oil (IOCL), Bharat Petroleum (BPCL), Hindustan Petroleum (HPCL), and MRPL, as part of India’s domestic ethanol procurement program (EBPP).

In a separate update, Gulshan Polyols received ₹5.38 crore in Production Linked Fiscal Assistance from the Madhya Pradesh Industrial Development Corporation (MPIDC).

Bearish Technical Indicators

On the weekly chart, Gulshan Polyols’ stock continues to remain in bearish, showing sustained weakness below key resistance levels, said SEBI-registered analyst Sunil Kotak.

The long-term supply zone lies between ₹160 – ₹166, and as long as the stock trades below this range, bearish sentiment is expected to persist.

The weekly relative strength index (RSI) stands near 43, indicating limited momentum and a lack of strong buying pressure.

Technically, the stock also trades below its long-term trendline, reinforcing the negative bias. A decisive breakout above ₹166 would be required to shift the trend, while any failure to hold current levels could invite further downside pressure.

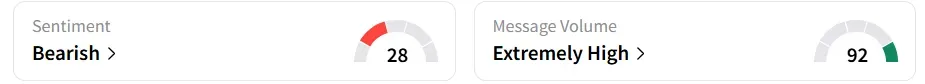

Retail Sentiment: Bearish

Despite the strong intra-day gains, retail sentiment on Stocktwits turned ‘bearish’ from ‘neutral’ a day earlier. Chatter on the platform was ‘extremely high’.

Year-to-date, the stock has shed over 11%. Over the last six months, the decline has been steeper at 25.6%.

For updates and corrections, email newsroom[at]stocktwits[dot]com. <