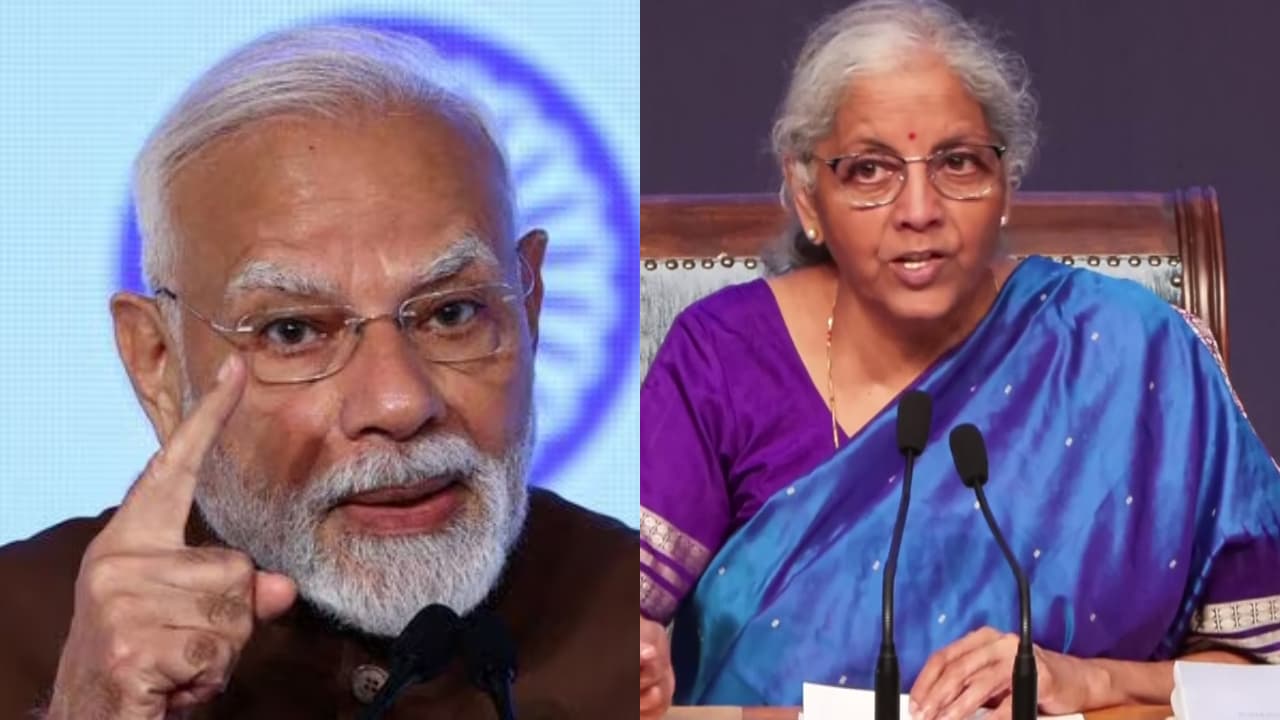

PM Modi hailed the GST Council’s approval of a two-tier 5% and 18% rate structure from Sept 22, calling it a step towards ease of living and doing business. Life and health insurance policies will now be exempt from GST, offering relief to families.

Prime Minister Narendra Modi on Wednesday lauded the sweeping reforms cleared by the GST Council, saying the measures would not only improve the lives of citizens but also ensure ease of doing business, particularly for small traders and entrepreneurs. The GST Council gave its nod to a simplified two-tier rate structure of 5% and 18%, which will come into effect from September 22.

In a post on X, the Prime Minister highlighted that the Union government had prepared a detailed proposal for broad-based GST rate rationalisation and process reforms, with a dual focus on making daily life easier for ordinary people and strengthening India’s economy.

What PM Modi Said?

Sharing his optimism, PM Modi stated:

“During my Independence Day Speech, I had spoken about our intention to bring the Next-Generation reforms in GST. The Union Government had prepared a detailed proposal for broad-based GST rate rationalisation and process reforms, aimed at ease of living for the common man and strengthening the economy.”

“Glad to state that @GST_Council, comprising the Union and the States, has collectively agreed to the proposals submitted by the Union Government on GST rate cuts & reforms, which will benefit the common man, farmers, MSMEs, middle-class, women and youth,” he added.

He further asserted, “The wide ranging reforms will improve lives of our citizens and ensure ease of doing business for all, especially small traders and businesses.”

Also read: GST Shake-Up: What Gets Cheaper, What Gets Dearer? Check Full List of Items Under 0%, 5%, 18% & 40% Slabs

Scroll to load tweet…

GST Bonanza: Tax rates slashed from roti/paratha to TVs

Finance Minister Nirmala Sitharaman announced consolidation of 12% and 18% slabs into a dual rate structure of 5% and 18% besides 40% for sin goods.

The simplification is part of the “Next-Generation GST” reform initiative, designed to boost affordability, consumption, and economic efficiency.

“In common man and middle class items, there is a complete reduction. This reform is not just about rationalising rates. It’s also on structural reforms. It’s also about ease of living, so that businesses can conduct their operations with the GST with great ease. We’ve reduced the slabs. There shall be only two slabs, and we are also addressing the issues of compensation cess,” Sitharaman said at a late evening press conference.

“These reforms have been carried out with a focus on the common man. Every tax on the common man’s daily use items has undergone a rigorous review, and in most cases, the rates have come down drastically. Labour-intensive industries have been given good support. Farmers and the agriculture sector, as well as the health sector, will benefit,” Sitharaman said.

“We have corrected inverted duty structure problems, we’ve resolved classification-related issues, and we’ve ensured that there will be stability and predictability about the GST. We’ve reduced the slabs. There shall be only two slabs, and we are also addressing the issues of compensation, ease of living, simplifying registration, return filing and refunds,” she added.

Scroll to load tweet…

Items on which GST has been reduced to 5% include hair oil, toilet soap, soap bars, shampoos, toothbrushes, toothpaste, bicycles, tableware, kitchenware, and other household articles.

Items on which GST has been reduced to zero from 5% include ultra-high temperature milk, chena and paneer. All Indian breads will be available at a nil rate. So roti or paratha or whatever it is, they all come to nil.

There is a reduction of GST from 12% or from 18 % to 5% on food items- namkeen, bujjiya, sauces, pasta, instant noodles, chocolates, coffee, preserved meat, cornflakes, butter, and ghee. All these will be in 5% category.

She announced reduction from 28 % to 18% on air conditioning machines, dishwashing machines, small cars. Motorcycles equal to or less than 350 cc are all now coming to 18%..

In his Independence Day address, Prime Minister Narendra Modi had said that next-generation GST reforms by Diwali will reduce taxes on daily essentials, benefiting MSMEs, local vendors, and consumers, while simultaneously stimulating economic growth and creating a more efficient, citizen-friendly economy.

(With Inputs from ANI)