From Nov 1, 2025, low-risk applicants with a monthly GST liability under ₹2.5 lakh can get automated registration within 3 days. The simplified scheme aims to ease compliance for small traders under the next-gen GST reforms.

Low-risk applicants and those whose tax liability on supplies to registered persons will not exceed Rs 2.5 lakh per month will be granted GST registration on an automated basis within three working days from the date of submission of the application, a senior official said on Tuesday.

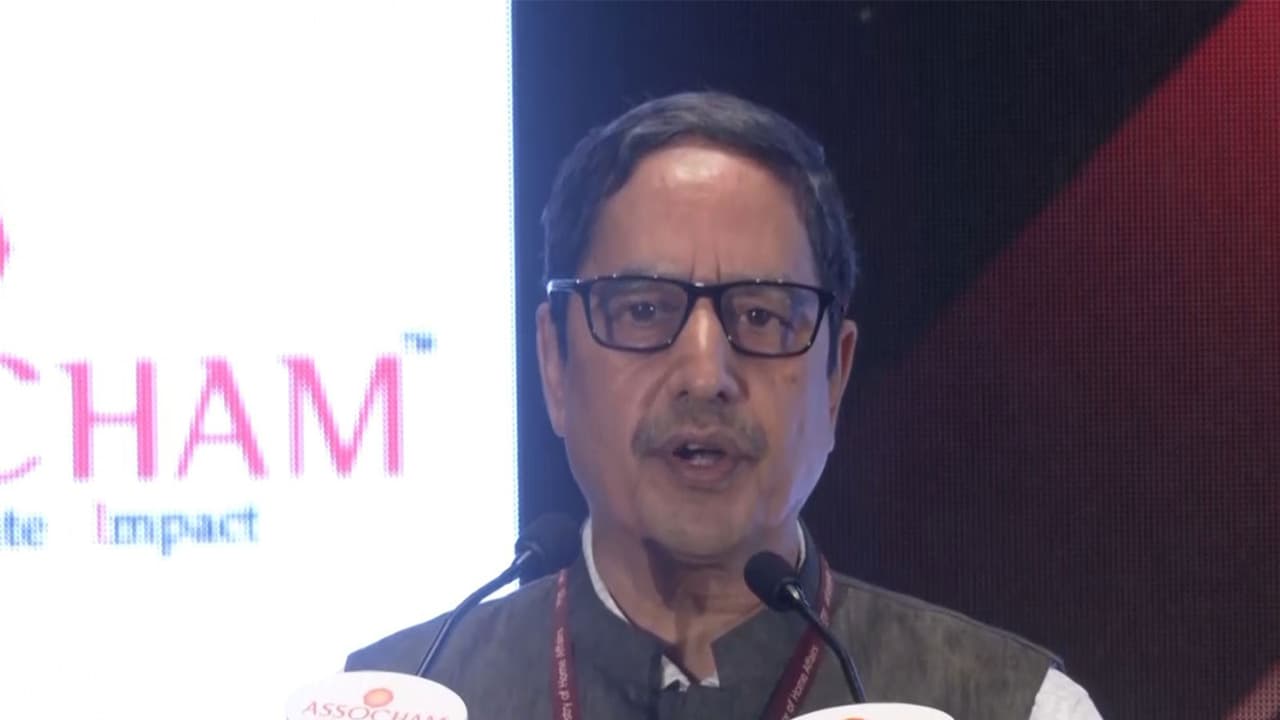

Shashank Priya, Special Secretary and Member (GST), CBIC, Ministry of Finance, underlined the benefits of the recent GST reforms at the ASSOCHAM conclave. The simplification of the GST registration process was recommended by the GST Council in its September 3 meeting, where sweeping changes were made to the GST rates.

“On registration, we have gone to and fro. Earlier, we had a very simplified system, and because of its misuse, we made it tighter again. However, there have now been complaints from small traders, particularly small operators. We are rolling out a new scheme from November 1, 2025,” the Special Secretary and Member (GST) said today, addressing the National Conclave on GST 2.0: “Next Generation GST Reforms for Viksit Bharat”, organised by ASSOCHAM.

Scroll to load tweet…

“Those who are going to declare that their tax passing off Input Tax Credit in a month will not be more than Rs 2.5 lakh, they will get automated registration within three working days,” he added.

GST Registration Simplified for Low-Risk Applicants from Nov 1

In addition, certain trusted categories, including the public sector, will be eligible for this benefit, the official further said at the Conclave.

The GST Council had recommended the introduction of an optional simplified GST registration scheme wherein registration shall be granted on an automated basis within three working days from the date of submission of application in case of low-risk applicants and applicants who, based on their own assessment, determine that their output tax liability on supplies to registered persons will not exceed Rs. 2.5 lakh per month (inclusive of CGST, SGST/UTGST and IGST).

The scheme will provide for voluntary opting into and withdrawal from the scheme.

This is expected to benefit around 96 per cent of new applicants applying for GST registration, according to the Ministry of Finance. This shall be operationalised from November 1, the minister had earlier indicated.

GST Boosts Revenue, Simplifies Compliance and Trade

In his address, the Special Secretary also acknowledged that while the Goods and Services Tax (GST) is not perfect, but it has significantly improved the indirect tax ecosystem compared to the pre-GST era.

The standard IT infrastructure has streamlined the process, allowing all taxpayers to use a single portal for both state and central government taxes, enhancing synergy, trade facilitation, and compliance.

The elimination of state border checks, he said, has reduced logistics costs for industries.

Since its implementation, GST has seen over 200% growth in revenue and more than 100% growth in registered taxpayers, indicating increased formalisation, he told the gathering.

Major Cuts Take Effect from first day of Navratri

On September 3, sweeping changes were made under the next-generation GST (Goods and Services Tax) rationalisation, just days after Prime Minister Narendra Modi announced it from the ramparts of the Red Fort on Independence Day. The GST Council has reduced the GST structure from four slabs (5%, 12%, 18%, 28%) to two main rates–5% (merit rate) and 18% (standard rate) along with a 40% special rate for sin/luxury goods.

This is aimed at reducing the tax burden on citizens while stimulating economic growth.

The GST Council, after a threadbare discussion, approved significant rate cuts across multiple sectors, which the government has described as a Diwali gift for the nation. The announcements were made by Finance Minister Nirmala Sitharaman.

As high as 99% of all goods that were previously in the 12% GST bracket have now been brought down to the 5% GST bracket, Finance Minister Nirmala Sitharaman said recently.

On September 22, the first day of Navratri, all changes to GST rates took effect.

(Except for the headline, this story has not been edited by Asianet Newsable English staff and is published from a syndicated feed.)