The Groww IPO appears to be attracting attention on its final day of bidding, which is today (November 7). As of noon, Groww IPO subscription status stands at 3.81 times.

Meanwhile, the Pine Labs IPO, the latest entrant to the primary market, is gradually generating interest. Groww IPO GMP today stands at ₹5; meanwhile, Pine Labs IPO GMP is also trading at ₹5.

Experts suggest that there are many opportunities available in the market, with additional IPOs anticipated. The recent track record has been less than favourable, with several strong IPOs trading at considerable discounts from their peak prices shortly after their debut. Therefore, investors should proceed with caution and avoid excessive enthusiasm, advised analysts.

Commenting on which IPO to invest in, Harshal Dasani, Business Head, INVasset PMS, said Pine Labs IPO and Groww IPO reflect two distinct themes in India’s fintech evolution – enterprise payments versus retail investing.

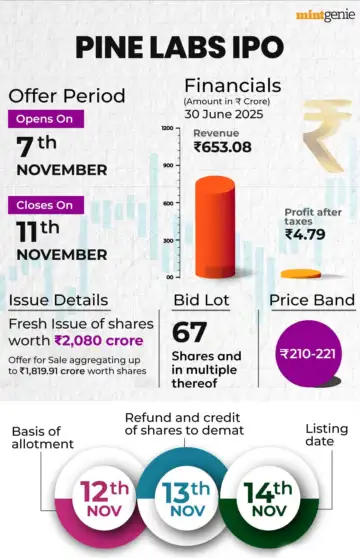

Dasani explained that Pine Labs, valued at around $3 billion, offers a compelling entry into India’s merchant and point-of-sale ecosystem. With strong backing from global investors, its ₹2,080 crore issue is focused on expansion across Southeast Asia and digital-lending integrations.

The company’s revenue mix is diversified, margins are improving, and valuation has normalised to nearly half its 2022 peak – a sign of pragmatic pricing, believes Dasani.

Meanwhile, Groww, he said, represents India’s booming retail-investment story. With over 8 crore active users and a profit turnaround in FY25, the platform commands clear market leadership in digital broking.

“Yet, its IPO valuation near 40x earnings leaves limited headroom for error, especially as SEBI tightens derivative exposure and the industry faces rising competition,” said Dasani.

From a portfolio-allocation standpoint, he finds Pine Labs offering a steadier risk-reward through a payments and SaaS-linked model, while Groww remains a high-growth but high-valuation consumer-tech play.

“Investors seeking a scalable fintech with more balanced upside may find Pine Labs relatively better positioned, whereas momentum-driven investors can look to Groww – provided they accept near-term volatility for long-term digital finance exposure,” he added.

Anuj Gupta, Director at Ya Wealth, favours the Groww IPO and said that Groww is the best bet.

Gupta noted that Groww boasts around 14.38 million active users, with Zerodha and Angel One its close competitors. However, Angel One’s stock has corrected by nearly 29% over the past two years, reflecting the broader challenges facing the broking industry, particularly amid ongoing regulatory reforms introduced by SEBI.

“Groww brand is growing, but GMP is only ₹14, which is not so much aggressive. Investors can subscribe to this IPO for listing gain. The main objectives of the Groww IPO are to fund business growth, provide an exit for existing investors, and augment the capital base of its subsidiaries,” added Gupta.

Let’s take a look at the grey market premium (GMP) trends:

Groww IPO GMP today

Groww IPO grey market premium is ₹5. Considering the upper end of the IPO price band and the current premium in the grey market, the estimated listing price of Groww is indicated at ₹105 apiece, which is 5% higher than the IPO price of ₹100.

According to the grey market trends observed over the last 10 sessions, Groww IPO GMP is declining and is anticipated to decrease further. Experts note that the minimum GMP stands at ₹5.00, whereas the maximum GMP reaches ₹16.70.

Pine Labs IPO GMP today

Pine Labs IPO GMP is ₹5. Considering the upper end of the IPO price band and the current premium in the grey market, the estimated listing price of Pine Labs is indicated at ₹226 apiece, which is 2.26% higher than the IPO price of ₹221.

According to the activities in the grey market over the last six sessions, today’s IPO GMP is trending downward and is anticipated to decline further. Experts indicate that the lowest GMP has reached ₹5, whereas the highest GMP is recorded at ₹60.

‘Grey market premium’ indicates investors’ readiness to pay more than the issue price.