Congress’s Jairam Ramesh called PM Modi’s GST reforms inadequate, calling GST a ‘growth-suppressing tax’. He flagged unaddressed problems: too many slabs, high rates on daily items and incomplete sectoral relief. The Congress demands a full GST 2.0.

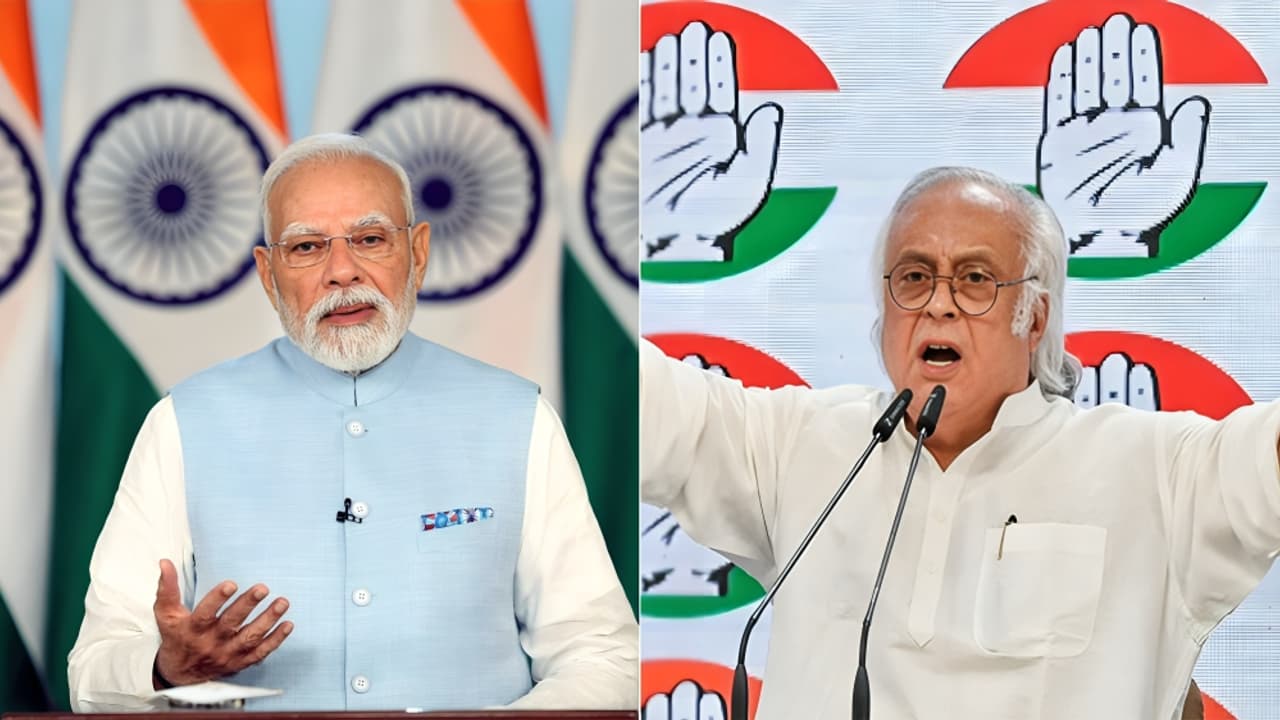

The Congress party on Sunday sharply criticised Prime Minister Narendra Modi’s address to nation about the GST reforms. Congress leader Jairam Ramesh said that PM Modi claimed sole ownership of amendments made by the GST Council, which is a constitutional body. Ramesh wrote on X that while the reforms have been announced, they are not enough. He said his party has long argued that the GST is a ‘growth-suppressing tax’.

His X post read, “The Prime Minister addressed the nation today to claim sole ownership of the amendments made to the GST regime by the GST Council, a constitutional body. The Indian National Congress has long argued that the GST has been a Growth Suppressing Tax. It is plagued with a high number of tax brackets, punitive tax rates for items of mass consumption, large-scale evasion and misclassification, costly compliance burdens, and an inverted duty structure (lower tax on output as compared to inputs). We have been demanding a GST 2.0 since July 2017 itself. This was a key pledge made in our Nyay Patra for the 2024 Lok Sabha Elections.”

Scroll to load tweet…

What Congress objects to

Ramesh listed the following concerns:

- Too many tax brackets remain, making GST complex.

- Some mass-consumption items still taxed heavily.

- Widespread evasion and misclassification of goods/services.

- High compliance costs for small and medium enterprises (MSMEs).

- An inverted duty structure, where inputs are taxed more heavily than outputs.

He also said sectoral issues remain unaddressed: textiles, tourism, exporters, handicrafts and agricultural inputs.

Demand for GST 2.0 and state concerns

Congress says it has been asking for GST 2.0 since July 2017. Ramesh also raised the issue of thresholds for interstate supplies for MSMEs, which he said should be increased. He argued that certain major demands by states are still unmet: extension of revenue compensation for another five years and covering more items like electricity, alcohol, petroleum, real estate under GST or state-level taxes.

Ramesh asked whether these delayed reforms will really boost private investment and GDP growth. He pointed out that India’s trade deficit with China has doubled over the last five years, crossing $100 billion. Similarly, he warned that many Indian businesses are being hurt by oligopolies and are considering moving abroad.

PM Modi’s recent announcements

Jairam Ramesh’s criticism came soon after PM Modi addressed the nation, announcing ‘next-generation’ GST reforms starting from September 22. He described these changes as part of ‘GST Bachat Utsav’. PM Modi said that the reforms would benefit the poor, middle class, farmers, women, traders, and ensure easier business.

He also said that these reforms mark an important step towards India becoming more self-reliant (Aatmanirbhar Bharat) and simplifying the tax system.

Congress’s view vs public expectations

While the government emphasises relief and simplification, Congress believes the reforms do not go far enough. They argue that many structural problems remain. The debate centres around whether the announced changes are sufficient to address real issues of compliance cost, fairness, burden on small businesses, and economic growth.

The political context is that these reforms are being rolled out ahead of Navratri and festive season, when economic sentiment, consumer spending, and political messaging are all very important.