- Goldman aims to raise $100 billion across private credit, real estate, and hedge fund strategies.

- According to a Bloomberg Report, the firm has been in talks with KIA to secure the money over the next few years across multiple funds.

- Goldman Sachs is stepping up its push into private markets and alternative assets to reduce its reliance on trading and investment banking income.

Goldman Sachs Group Inc. (GS) is reportedly in advanced discussions with the Kuwait Investment Authority (KIA) to land a $10 billion mandate for its asset management division.

According to a Bloomberg Report, the firm has been in talks with KIA to secure the money over the next few years across multiple funds, primarily focused on Goldman’s private equity, credit, and infrastructure investments.

Goldman Sachs opened an office in Kuwait on October 6. The firm appointed Mohammad Almatrouk as Managing Director to head it, while it appointed Fahad Alebrahim as Managing Director for the Private Wealth Management business.

Finance Firms Eye Middle East Money

Similar to other global financial behemoths such as Blackstone, KKR, and Apollo Global Management, Goldman Sachs is looking to expand its footprint in the Middle East by attracting the region’s sovereign investors who manage trillions of dollars in assets.

Earlier this month, Goldman established a private wealth management team in Saudi Arabia, strengthening its Middle East presence to cater to the region’s expanding base of high-net-worth clients.

Goldman Sachs is stepping up its push into private markets and alternative assets to reduce its reliance on trading and investment banking income.

In an earnings call earlier this month, CEO David Solomon said the firm aims to raise about $100 billion this year across private credit, real estate, and hedge fund strategies, beating earlier projections. By the end of the third quarter, the bank had $374 billion in alternative assets under supervision.

How Did Stocktwits Users React?

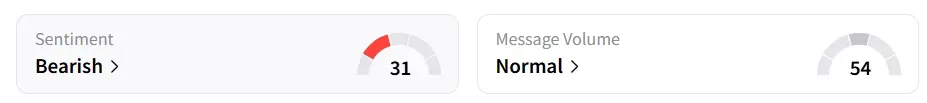

Goldman Sachs’ shares traded over 1% higher on Monday. While the stock is on track to gain for a third consecutive session, retail sentiment on Stocktwits remains ‘bearish’. It was ‘extremely bullish’ a week ago.

The stock has seen strong buying interest so far this year, gaining more than 37%.

For updates and corrections, email newsroom[at]stocktwits[dot]com. <