VICI Properties announced an agreement to acquire seven Golden Entertainment casino properties for $1.16 billion.

- The seven properties feature 362,000 square feet of gaming space, over 6,000 hotel rooms, 4,306 slot machines, and 78 table games.

- The deal will see VICI retire $426 million of Golden Entertainment’sdebt.

- Golden Entertainment also reported its Q3 earnings with a decline in revenue.

Shares of Golden Entertainment Inc. (GDEN) surged 40% in early trade on Thursday, after VICI Properties Inc. (VICI) announced an agreement to acquire seven casino properties of the company for $1.16 billion.

The stock has also crossed its 200-day moving average for the first time since July this year.

The properties, also known as the Golden Portfolio, comprise The STRAT Hotel, Casino & Tower on the North Las Vegas Strip, Arizona Charlie’s Decatur and Arizona Charlie’s Boulder in Las Vegas, Aquarius and Edgewater Casino Resorts in Laughlin, and the Pahrump Nugget Hotel & Casino and Lakeside RV Park & Casino in Pahrump.

Together, these assets feature 362,000 square feet of gaming space, over 6,000 hotel rooms, 4,306 slot machines, and 78 table games.

The deal also includes a triple-net master lease with a new entity, Golden OpCo, owned by GDEN’s CEO, Blake L. Sartini, which will operate the casinos.

VICI will assume and retire $426 million of GDEN’s debt using existing liquidity. The transaction is expected to close in mid-2026.

In a letter dated November 6, Everbay Capital LP, a shareholder of Golden Entertainment since 2021, urged the casino operator to pursue a sale-leaseback of its casino real estate assets and use the proceeds to repay debt and pay a special dividend to shareholders.

Q3 Results Disappoint

Around the same time, Golden Entertainment reported weak third-quarter earnings, with revenue falling to $154.8 million from $161.2 million in the same quarter last year. The company reported a net loss of $4.7 million, compared with net income of $5.2 million in the previous corresponding period.

What Does Retail Data Indicate?

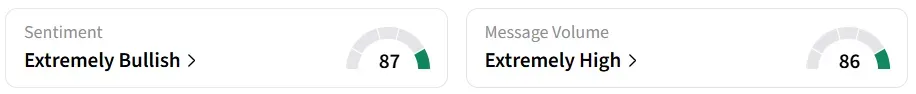

The deal turned retail sentiment on Stocktwits to ‘extremely bullish’ from ‘neutral’ a session earlier. It was accompanied by ‘extremely high’ message volumes.

Around 1.1 million shares changed hands in just one hour of trading, over five times the average, according to Stocktwits data. Year-to-date, GDEN stock has declined 8.9%.

On the other hand, VICI shares were up marginally at 0.17%.

For updates and corrections, email newsroom[at]stocktwits[dot]com<