Spot gold prices slumped more than 8% on Friday, falling below the $5,000 an ounce for the first time since January 23, while spot silver plummeted to $91.6 per ounce from $115.6 in the previous session.

- Silver futures for March 2026 deliveries plunged 19% to $91.88 per ounce.

- Gold futures for February 2026 deliveries fell 6.6% to $4,970 an ounce.

- The dollar index (DXY), which tracks the currency against a basket of six major peers, climbed 0.9% to 97.

Spot gold prices slumped more than 8% on Friday, falling below the $5,000 for the first time since January 23, as the precious metals market witnessed a sharp sell-off after weeks of rallying.

The XAU/USD pair was down 8% to $4,940 an ounce at the time of writing. Gold futures for February 2026 deliveries fell 6.6% to $4,970 an ounce.

Meanwhile, silver crashed more than 20% with spot prices plummeting to $91.6 per ounce from $115.6 in the previous session. Silver futures for March 2026 deliveries plunged 19% to $91.88 per ounce.

The U.S. dollar moved higher on reports that the Trump administration is set to tap Kevin Warsh as the next Federal Reserve chair. The dollar index (DXY), which tracks the currency against a basket of six major peers, climbed 0.9% to 97.

Warsh, a former Fed governor long viewed as tough on inflation, has lately called for lower interest rates. President Donald Trump is widely expected to announce his pick soon, with Warsh emerging as a top candidate to replace Jerome Powell when his term ends in May.

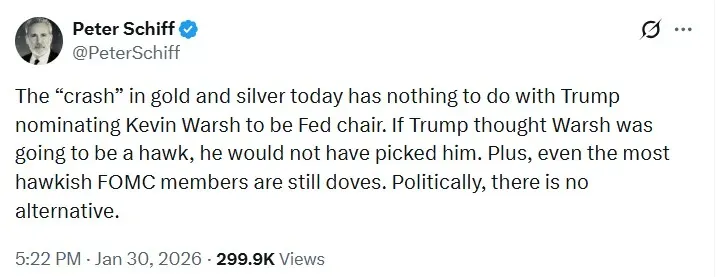

Peter Schiff’s Take

In a post on X, economist Peter Schiff stated that the sharp drop in gold and silver isn’t really about Trump nominating Kevin Warsh as the next Fed chair. He said if Trump believed Warsh would take a hawkish stance, he likely wouldn’t have chosen him, and that politically, there is no alternative.

ETFs Crash

The iShares Silver Trust slid to its lowest since January 16. As of Thursday’s close, SLV was up roughly 56% for the year, but the gains pared down to 22%. The SPDR Gold Shares ETF gains fell to 12.6% so far in 2026.

Meanwhile, shares of silver miners First Majestic (AG), Hecla Mining (HL), and Pan American Silver Corp. (PAAS) declined around 11% while gold miners Newmont Corp. (NEM) and Barrick Gold (B) traded 10% lower.

Read also: Why Did CRML Stock Jump 5% Today?

For updates and corrections, email newsroom[at]stocktwits[dot]com.<