Global markets today: Asian markets mostly traded higher as investors evaluated the S&P 500’s four-day losing streak, driven by declines in technology stocks.

Market participants in the region are also awaiting India’s HSBC Composite flash purchasing managers’ index (PMI) for August, which offers an early read on private sector activity and is expected later in the day.

Japan’s Nikkei 225 slipped 0.21 per cent in early trading, with the broader Topix falling 0.4 per cent.

South Korea’s Kospi gained 0.81 per cent, while the Kosdaq climbed 0.62 per cent. Australia’s S&P/ASX 200 opened 0.47 per cent higher.

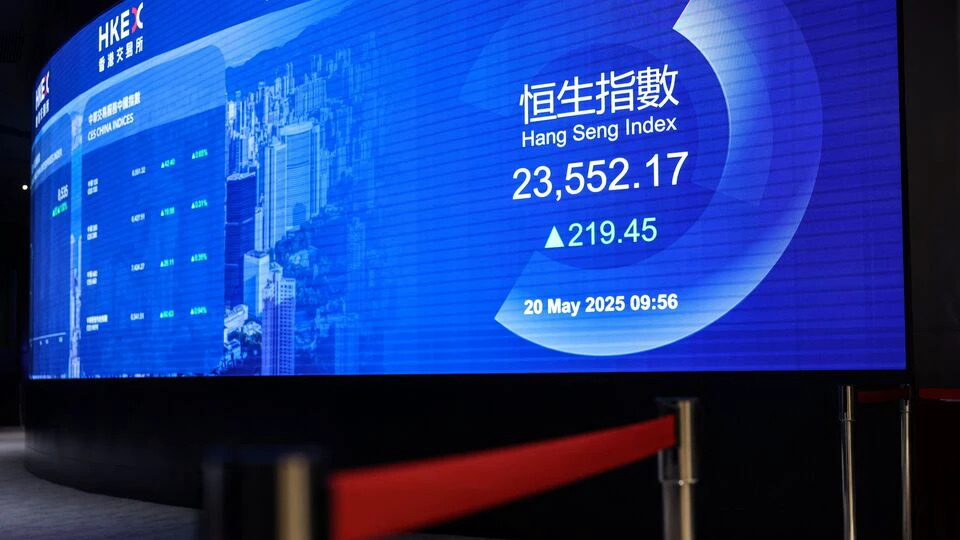

Meanwhile, Hong Kong’s Hang Seng index is expected to open flat, with futures at 25,168 compared to the previous close of 25,165.94.

U.S. stock market today

The Nasdaq and S&P 500 declined on Wednesday as investors trimmed their holdings in tech stocks and shifted toward less overvalued sectors, while also awaiting comments from Federal Reserve officials at the Jackson Hole symposium later this week.

The S&P 500 slipped 16.40 points, or 0.26 per cent, to close at 6,394.97, and the Nasdaq Composite dropped 144.76 points, or 0.68 per cent, to 21,170.19. Meanwhile, the Dow Jones Industrial Average edged up by 1.48 points, or 0.00 per cent, to settle at 44,923.75.

Technology shares, which had fueled much of Wall Street’s rebound from April’s selloff, continued to retreat, while sectors including energy, healthcare, and consumer staples advanced.

Minutes from the Fed’s July meeting revealed that while interest rates remained unchanged, nearly all policymakers agreed it was appropriate to keep the federal funds rate target range at 4.25% to 4.50%, with only two members dissenting.

Federal Reserve Chair Jerome Powell is scheduled to speak on Friday at the central bank’s annual Jackson Hole conference in Wyoming. Markets will closely monitor his comments for potential policy cues, as investors are anticipating a 25-basis-point rate cut in September, according to LSEG data.