Global Markets Today: Asian markets mostly declined on Wednesday, following Wall Street’s losses as investors weighed rising global bond yields and recent trade developments.

Australia’s S&P/ASX 200 slipped 0.52 per cent ahead of the release of its second-quarter GDP data.

Japan’s Nikkei 225 fell 0.43 per cent, and the broader Topix index dropped 0.35 per cent.

In South Korea, the Kospi edged up 0.16 per cent, while the small-cap Kosdaq remained unchanged.

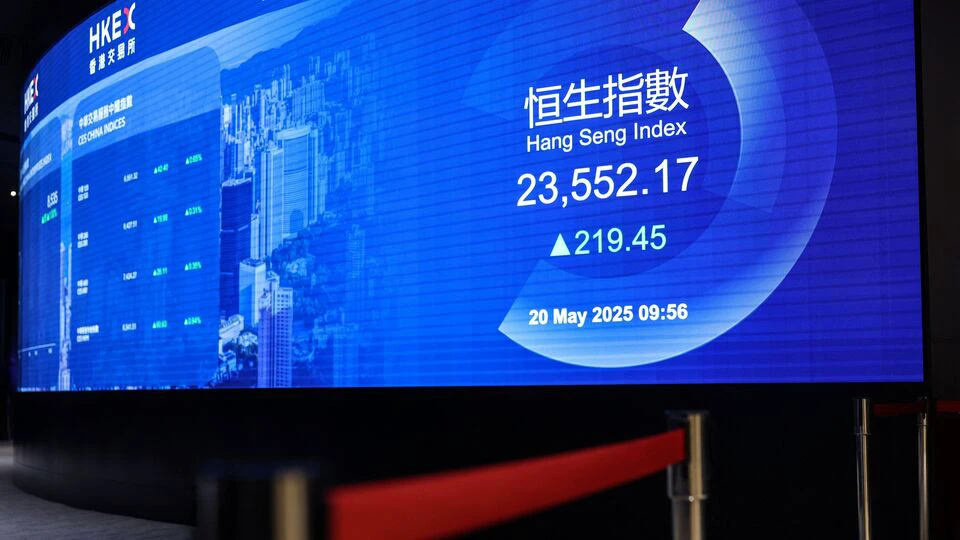

Futures for Hong Kong’s Hang Seng index were at 25,445, indicating a softer opening compared to its previous close of 25,496.55.

Chinese markets are expected to remain in focus as President Xi Jinping prepares to address a military parade marking the 80th anniversary of the end of World War II later today. The event will be attended by 26 global leaders, including Russian President Vladimir Putin and North Korea’s leader Kim Jong Un.

U.S. stock market today

Wall Street opened September on a weak note Tuesday, with stocks falling as investors assessed the future of President Donald Trump’s tariffs after a federal appeals court deemed most of them illegal.

A divided U.S. appeals court ruled on Friday that the majority of Trump’s tariffs are unlawful but permitted them to remain in effect until October 14. On Tuesday afternoon, Trump announced that his administration would seek an expedited ruling from the Supreme Court regarding the tariffs.

The Dow Jones Industrial Average dropped 249.07 points, or 0.55 per cent, to 45,295.81, the S&P 500 declined 44.72 points, or 0.69 per cent, to 6,415.54, and the Nasdaq Composite slipped 175.92 points, or 0.82 per cent, to 21,279.63.

U.S. rate futures strongly anticipate that the Federal Reserve will reduce interest rates this month, with a 92% probability of a 25-basis-point cut at the conclusion of its two-day policy meeting on September 17, according to CME Group’s FedWatch.

“Markets are being rattled by a cocktail of fiscal fears, geopolitical uncertainty, and central bank politics. Gold’s rally to record highs shows how nervous investors are, but Friday’s US jobs report could be the real catalyst for the next big move. Whether the Fed cuts rates this month may well hinge on the data,” said Lukman Otunuga, Senior Market Analyst at FXTM.