- The board has cleared a preferential issue of warrants worth ₹ 6,196 crore to Blackstone’s affiliate, Asia II Topco XIII.

- Upon conversion, the deal will give Blackstone a close to 10% stake and a board nomination right.

- The move follows big-ticket deals involving Emirates NBD-RBL Bank and SMBC-Yes Bank.

Indian private lender Federal Bank has announced that its board has approved a ₹6,196.5 crore preferential issue of warrants to Blackstone’s affiliate.

In a press release dated October 24, Federal Bank stated that the warrants will be issued to Asia II Topco XIII on a private placement basis.

The investment agreement will see Federal Bank issue up to 27.29 crore warrants, each convertible into one fully paid-up equity share at ₹227 per share, including a premium of ₹225. On full conversion, Blackstone will acquire about 9.99% of the bank’s paid-up equity capital.

Asia II Topco XIII will pay 25% upfront, with the remaining 75% payable upon conversion within the 18-month tenure of the warrants.

Federal Bank’s board has also granted Blackstone the right to nominate one non-executive director once all warrants are exercised and the firm maintains at least a 5% stake.

Indian Private Banks Get Global Attention

This strategic investment comes as mid-sized Indian banks attract global capital. Middle east lending giant Emirates NBD Bank is set to acquire a 60% stake in RBL Bank for around $3 billion (₹26,853 crore) through a preferential equity issuance of 96 crore new shares at ₹280 each. The deal will be the largest foreign direct investment (FDI) in the Indian banking sector.

Yes Bank has been in the news lately after Japan’s Sumitomo Mitsui Banking Corporation’s (SMBC) completed the acquisition of a 24.22% stake from State Bank of India (SBI) and other banks. The ₹8,889-crore transaction makes SMBC the largest shareholder.

What Is The Retail Mood On Stocktwits?

Federal Bank’s shares were up 0.5% at the time of writing, having gained as much as 1.9% earlier in the session. The stock is on track to post a fourth consecutive session of gains.

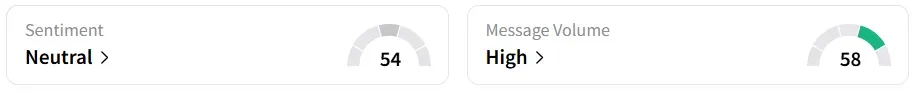

While retail chatter was ‘high’ on Stocktwits, sentiment fell to ‘neutral’ from ‘bullish’ a day earlier.

Year-to-date (YTD), the stock climbed 14.4%.

For updates and corrections, email newsroom[at]stocktwits[dot]com. <