GEV has rapidly transformed into a high-momentum energy and infrastructure powerhouse, capitalizing on explosive demand from data centers, grid modernization needs, and nuclear investments.

- GE Vernova is emerging as a standout performer thanks to accelerating orders, strong backlogs, margin gains, and rising free cash flow.

- The company is benefiting from surging data-center demand and expanding grid investments.

- The company recently issued a stronger-than-expected near and medium-term outlook at its investor event.

Once considered a bellwether of the economy, given the diverse businesses under its fold, GE was beginning to feel the weight of an unwieldy organization; its fundamentals suffered, and it was booted from the Dow Jones Industrial Average in 2018 after being part of the blue-chip average for more than a century.

Desperate times call for desperate measures. The company chose to take a bolder approach to streamline operations by effecting a tripartite split: the parent company was renamed GE Aerospace, GE Vernova (focused on energy), and GE Healthcare.

While the plan was mooted and communicated to the investors in November 2021, GE Healthcare was spun off in 2023, followed by the separation of GE Vernova, leaving parent GE as a pure-play aerospace company.

Far from a risky experiment, GE’s restructuring is emerging as one of Wall Street’s most effective value unlocks — with spin-off unit Vernova’s (GEV) AI-driven breakout validating the bet.

GEV’s Businesses

The company provides power generation products, such as gas turbines, to end markets including pulp & paper mills, mines, data centers, oil & gas, and hospitals. By energy sources, power accounted for roughly half of the company’s revenues in the September quarter, with wind and electrification contributing approximately 25% each.

GEV Lands In Data Center Sweetspot

When the company released its third-quarter results in late October, CEP Scott Strazik sounded positive about its order flow and backlogs:

“Our growth trajectory is accelerating and the demand environment for our equipment and services remains strong with $16 billion in backlog growth year-to-date. Our Gas Power equipment backlog and slot reservation agreements increased from 55 to 62 gigawatts sequentially, and our Electrification equipment backlog increased $6.5 billion year-to-date, to approximately $26 billion.”

The 55% order growth was exemplary by any standards. And more importantly, the company also reported significant margin expansion and positive free cash flow.

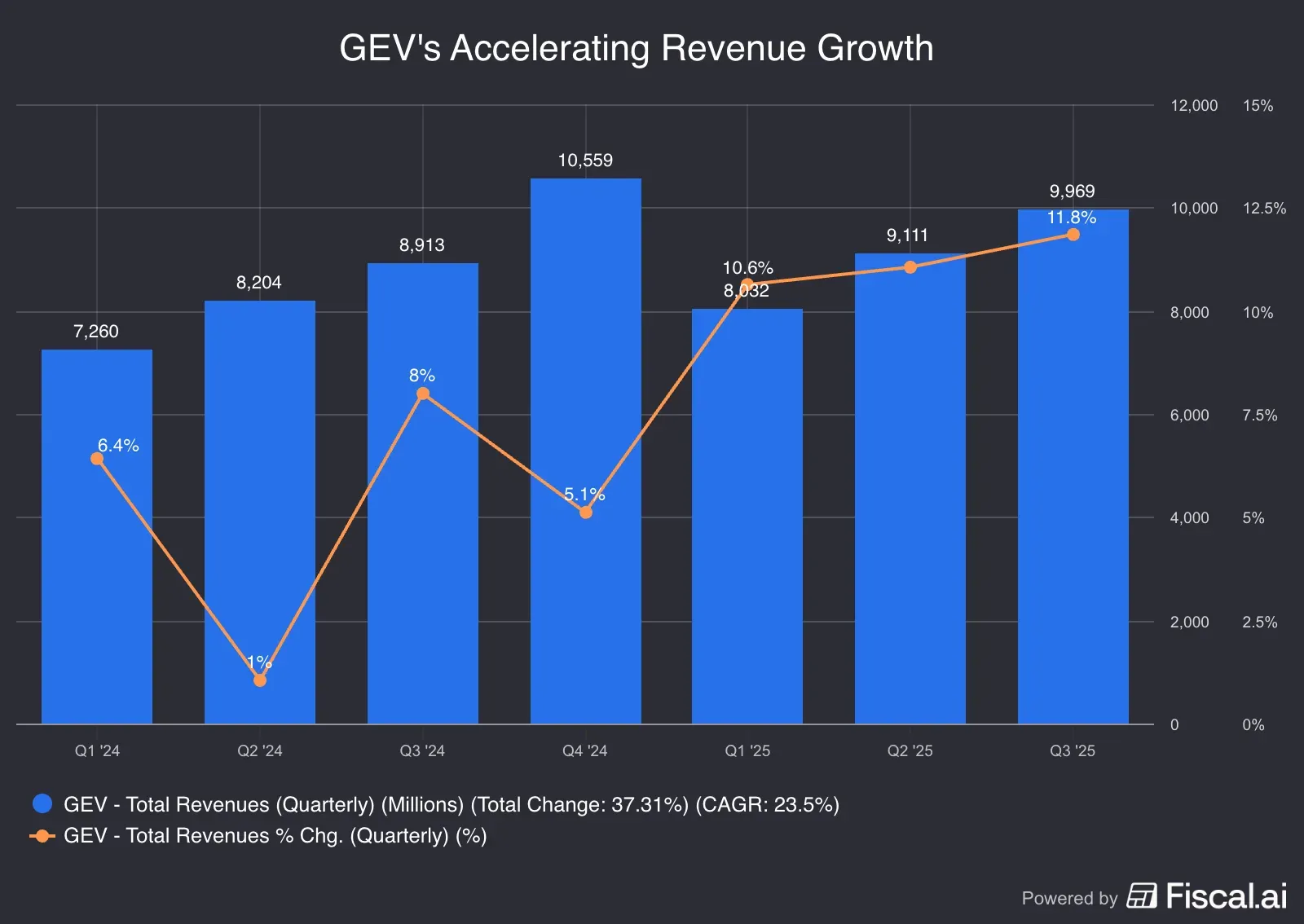

Source: Fiscal.ai<

On the earnings call, Strazik called data centers among the company’s “new archetype of customers.” He named data center growth as one of the three drivers of grid investment growth, which, in turn, is increasing demand for its products. He also noted that the company signed its first technology collaboration funding agreement with a hyperscaler for scope inside the data center.

To tap into the data center opportunity, the company agreed to acquire the remaining 50% of the Prolec GE joint venture from its partner, Xignux, by paying $5.275 billion in cash and debt. The company sounded upbeat about the complete ownership assumption:

“This is a business we know well and is an attractive acquisition for GE Vernova consolidating a leading grid equipment provider that produces transformers to serve North American utilities, industrials and data centers.”

The deal is expected to close by mid-2026.

Which GE Splinter Company’s Stock Fares Better?

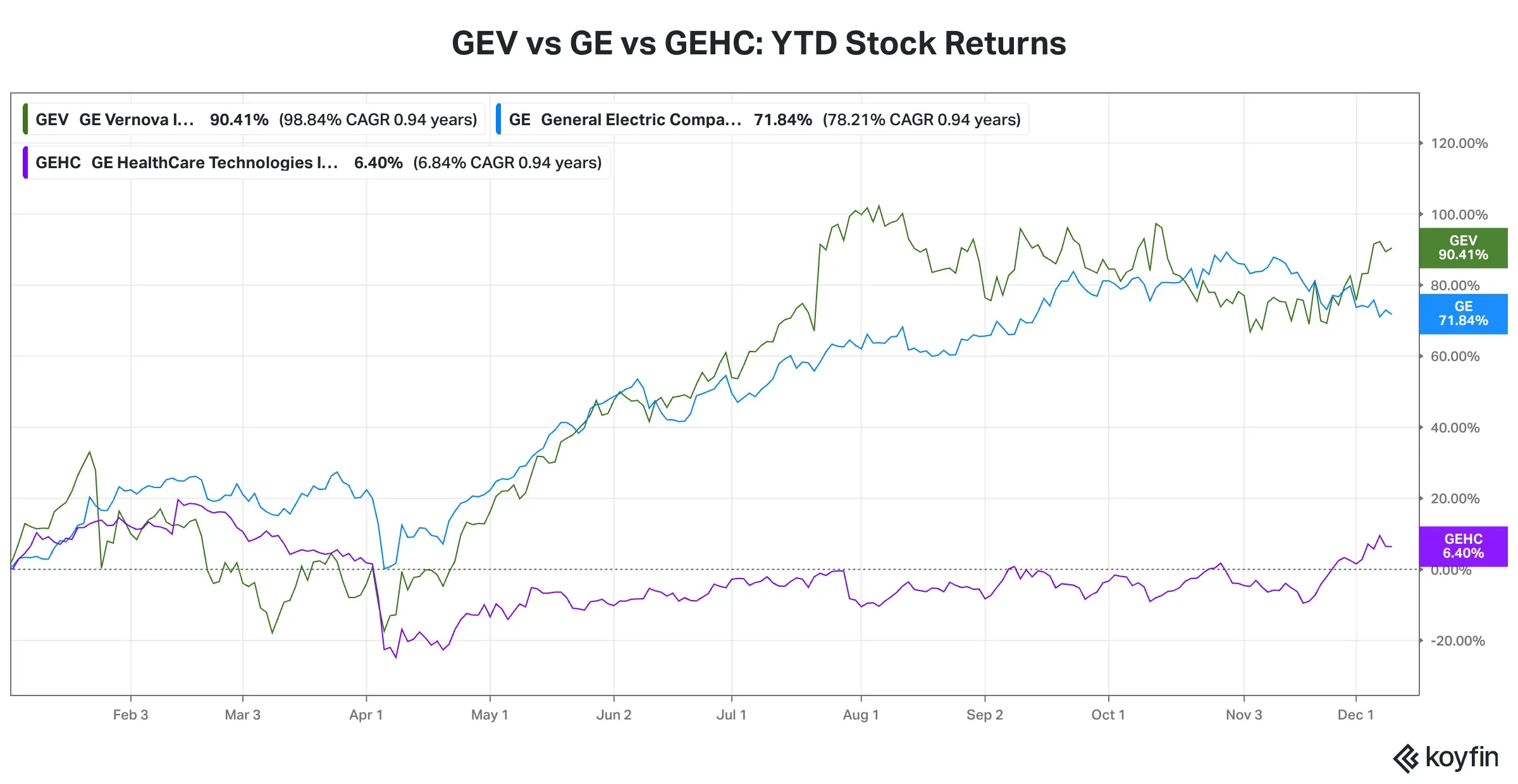

For the year-to-date period, GEV stock has gained 90.41%, outperforming the shares of GE Aerospace (GE) (up 72%) and GE Healthcare (GEHC) (up 6.5%).

Source: Koyfin<

Source: Koyfin<

GEV stock has been on a broader uptrend since its public listing. A mini uptrend that began when the stock hit a bottom in April lasted through late July, and since then, the stock has been broadly consolidating. Since its March 27, 2024 listing, the stock is up about 380%.

Source: Koyfin<

Source: Koyfin<

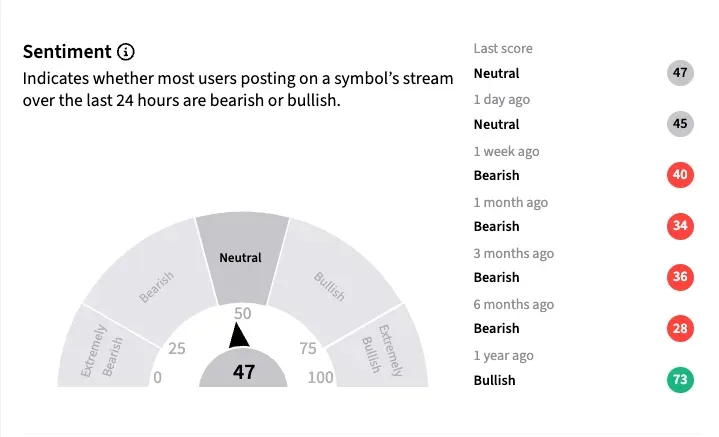

Retail sentiment toward GEV stock has remained muted. From ‘bullish’ a year ago, sentiment deteriorated to ‘bearishness,’ before ticking higher, although only to ‘neutral’ since this week.

Raft Of Positive Headlines

GEV stock has begun another uptrend in late November, buoyed by positive headlines. At the start of December, the company announced a $400 million funding grant to the Tennessee Valley Authority to continue accelerating the deployment of GE Vernova Hitachi Nuclear Energy’s BWRX-300 small modular reactor (SMR). Strazik said the BWRX-300 is the only commercial SMR technology currently being built in the Western world.

In its 2025 Investor Update, the company reaffirmed its 2025 revenue and adjusted earnings before interest, taxes, depreciation, and amortization (EBITDA) margin guidance. The company lifted its 2028 revenue outlook to low-double-digit organic growth from the high-single-digit growth it had forecast earlier.

It lifted its 2025 free cash flow guidance to $3.5 billion to $4 billion, which is expected to rise to $4 billion to $4.5 billion in 2026 and more than $22 billion by 2028.

Separately, GEV doubled its quarterly dividend to $0.50 per share and increased its buyback authorization to $10 billion.

GEV is also set to benefit from the rare-earth scramble, as China restricts the supply of these key materials used in multiple end products. Strazik reportedly said at the Investor event that the company is working with the government to increase yttrium stockpiles, a rare-earth element.

Following the investor update, GEV received a few upgrades and a slew of price-target hikes, according to summaries of notes from the Fly.

According to Koyfin, the average price target for GEV is $692.14, suggesting a 11% upside potential from current levels. Wall Street firms RBC Capital Markets and Oppenheimer upgraded the stock, assigning it bullish-equivalent ratings. With upward price target adjustments, the new price targets now range from $775 to $1,000 (JPMorgan).

BMO Capital Markets analysts called the medium-term projections better-than-expected and viewed the guidance as conservative, as it excluded pre-synergy EBITDA of $800 million from the pending deal to take full ownership of Prolec.

For updates and corrections, email newsroom[at]stocktwits[dot]com.<