Galecto announced the acquisition of Damora Therapeutics and a $285 million private raise backed by major biotech investors, including Viking Global, RA Capital, and a16z Bio + Health.

- Galecto announced the acquisition of Damora Therapeutics and a $285 million private raise backed by major biotech investors, including Viking Global, RA Capital, and a16z Bio + Health.

- The deal adds Damora’s portfolio of mutant calreticulin–targeting antibody therapies for rare blood cancers, with early human trial data expected in 2027.

- The acquisition positions Galecto to focus on next-generation treatments for myeloproliferative neoplasms, expanding its cancer pipeline alongside its ongoing AML drug program.

Shares of Galecto surged nearly 25% in premarket trading on Tuesday after the biotech firm announced the acquisition of Damora Therapeutics, a private company developing next-generation antibody drugs for rare blood cancers.

Galecto Bets Big On Blood Cancer Therapies

The acquisition gives Galecto control of Damora’s pipeline of mutant calreticulin (mutCALR)-targeting therapies, including DMR-001, a monoclonal antibody that aims to treat two difficult-to-manage bone marrow cancers, which are essential thrombocythemia and myelofibrosis. The company said the drug could be “best in class,” with the potential to work across a broad range of disease-driving mutations.

As part of the deal, Galecto raised $285 million in a private round that drew some of the biggest names in biotech investing, including Viking Global Investors, RA Capital Management, Wellington Management, Blackstone, BB Biotech, and Andreessen Horowitz’s a16z Bio + Health. The funding gives the company enough cash to operate well into 2029, with early human trial data for DMR-001 expected in 2027.

A New Chapter For Galecto

Galecto CEO Hans Schambye called the deal a “pivotal milestone” that positions the company to accelerate next-generation treatments for blood cancers driven by mutCALR, which account for roughly 25% of essential thrombocythemia and 35% of myelofibrosis cases in the U.S.

Incoming board member Peter Harwin, managing partner at Fairmount, said the combined financial and clinical resources will enable Galecto to advance DMR-001 from preclinical to human testing by mid-2026, with the goal of offering a safer, more convenient treatment option for patients.

Growing Its Cancer Pipeline

Beyond Damora’s assets, Galecto said it’s also advancing its own drug, GB3226, for acute myeloid leukemia (AML). The compound will be featured at the American Society of Hematology’s annual meeting in December, with an FDA filing expected in early 2026 to begin human testing.

Stocktwits Users Eye Multi-Day Rally

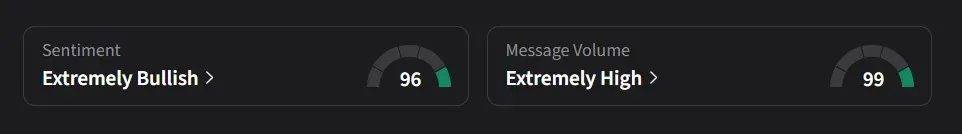

On Stocktwits, retail sentiment for Galecto was ‘extremely bullish’ amid ‘extremely high’ message volume.

One user speculated that Galecto’s stock could turn into a “multi-day runner,” hinting at continued momentum after its sharp surge.

Another user was far more bullish, predicting the stock could hit $50 next and even climb toward $150.

Galecto’s stock has surged by more than 270% so far in 2025.

For updates and corrections, email newsroom[at]stocktwits[dot]com.<