Galaxy Digital’s stock is on track to end the week higher, following a gloomy finish in the previous 5-day period, despite an almost 13% plunge on Wednesday following its earnings report. The stock also hit a fresh all-time high this week.

What Is Retail Thinking About Q3 Earnings?

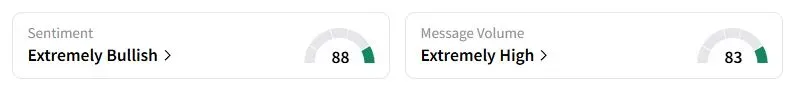

Retail sentiment on Stocktwits Galaxy Digital was in the ‘extremely bullish’ territory at the time of writing, with the ticket gaining over 11% new followers over the past seven days.

Most retail traders were upbeat about the stock despite the Wednesday dump, which tracked a broader decline in cryptocurrency markets. The company reported earnings per share (EPS) of $1.12, ahead of the consensus forecast of $0.38. Its revenue more than tripled to $28.4 billion, ahead of the estimated $17.25 billion. Galaxy offers institutional trading services for digital assets, along with data center capabilities, among other things.

“The game is simple: add as many shares as you can here. $50+ USD is coming quicker than you think,” one user said.

“Once Helios is on, it’s a money printer .. once in a lifetime opportunity,” another user said.

Cloud infrastructure firm CoreWeave (CRWV) has committed to using the full 800-megawatt capacity of Galaxy’s Helios data center in Texas. This pledge, combined with a $1.4 billion project financing deal secured from Deutsche Bank in August, fully funds phase one of the project and keeps it on schedule for its opening.

What Are Analysts Saying?

Galaxy’s “impressive quarter should help improve the narrative and make the case that Galaxy is much more than an HPC play,” Rosenblatt Securities analysts wrote, as per The Fly. The brokerage also raised the price target for the stock to $46 from $44.

Benchmark analysts reportedly stated that while the company’s move into AI and high-performance computing through the Helios facility has attracted the attention of more investors and analysts, but the third-quarter, the “strongest ever for its digital asset trading operations,” is a reminder that the company is “remarkably well positioned” to serve as a leading facilitator of the adoption of crypto by institutional investors. Benchmark analysts raised the stock’s price target to $57 from $40.

CEO Mike Novogratz Hopeful About Bipartisan Crypto Bill

Despite recent differences between Democratic and Republican lawmakers over the cryptocurrency bill, Galaxy CEO Mike Novogratz said on X that he was hopeful the bill would pass.

“Yes, there was some venting, but all in, there appears [to be] real interest on both sides for bipartisan legislation. Our industry needs to be bipartisan. I have faith this bill will get done,” Novogratz said.

Bitcoin was trading around $111,407.83 at the time of writing. The digital asset has rebounded over the past 24 hours ahead of the September inflation report, after a weak performance amid trade tensions between the U.S. and China.

For updates and corrections, email newsroom[at]stocktwits[dot]com.<