The presence of institutional, corporate and sovereign investmetn marks the culmination of crypto’s transition from volatility to validity.

After more than a decade of skepticism, boom-and-bust cycles, and regulatory tug-of-war, the cryptocurrency industry has unmistakably crossed into a new era. No longer dismissed as a speculative playground or a technological curiosity, digital assets are now being shaped by deep institutional inflows, clearer regulatory frameworks, and their expanding role within the global financial system.

The industry’s evolution is increasingly visible on the world stage. In a recent interview at the Singapore Fintech Festival, Binance CEO Richard Teng discussed crypto’s maturation process over the last few years, “Last year with the introduction of ETF, and then the different corporates and institutions jumping on the bandwagon to embrace and support crypto. For the longest time, you’re saying that this is scammy, this is a go away, it’s a passing fad, but now it’s here to stay. Last year and this year, we saw a lot of institutional adoption, a lot of institutional allocation. This year, we saw digital asset treasuries coming through, the different treasuries trying to do allocation. But it’s not only the corporates now, it’s the foundations, the family office, and even the sovereigns setting up their strategic asset reserve to invest in the crypto. So, that mention of digital asset treasury companies coming in.”

The presence of institutional, corporate and sovereign investmetn marks the culmination of crypto’s transition from volatility to validity. An industry now defining, rather than disrupting, the future of modern finance.

The Stability Pivot

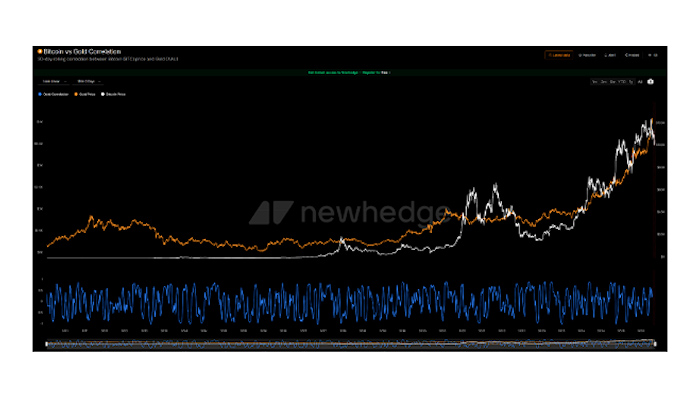

The shift from speculation to financial durability begins with Bitcoin’s maturation over fifteen years. Once dismissed as a fringe experiment, Bitcoin’s behavior now mirrors that of an emerging macro asset. Its 30-day correlation to gold frequently falls between 0.1 and 0.3, while its correlation to the S&P 500 often drops near zero, which is an increasingly cited reason why institutional allocators treat BTC as a digital store of value.

At the same time, Bitcoin’s structural design has helped reinforce that narrative. A fixed 21 million supply, four halving cycles, and its rise to a $1 trillion market cap during multiple market cycles have created a scarcity profile similar to commodities rather than equities shown in this chart.

As Bitcoin stabilized, the broader crypto ecosystem pivoted toward utility, programmability, and settlement-grade infrastructure. Ethereum’s 2015 mainnet launch introduced smart contracts—now the backbone of decentralized applications. Today, Ethereum processes over 1 million transactions per day, and smart-contract-enabled networks collectively secure more than $70–$90 billion in total value locked (TVL).

Those smart contracts catalyzed entire industry verticals: DeFi lending, DEXs, on-chain derivatives, and tokenized real-world assets (RWAs). These innovations continue to tighten the relationship between traditional and blockchain-based finance.

An illustrative example of this institutional maturation is Binance’s growth. Founded in 2017, Binance became the world’s largest crypto exchange by volume within a year. Today it regularly clears $10–$20 billion in daily trading volume, supports almost 300 million users globally, and offers a suite of enterprise-grade solutions including payments, conversion, custody, and institutional execution services.

Institutional Capital Accelerates Mainstream Integration

Nothing signals maturity like institutional capital. Since 2024, regulatory clarity in the E.U. and the U.S., coupled with the launch of crypto-based investment products like spot Bitcoin exchange-traded funds (ETFs), billions in capital from asset managers, pension funds, and university endowments have flowed into this asset class.

Publicly-traded corporations have also started to fill their war chests not with fiat currency, but with Bitcoin and other cryptocurrency reserves. Prominent examples include companies like MicroStrategy, as well as large-tech companies like Tesla and Block, Inc.

At the same time, mainstream financial institutions have started to embrace tokenization. From Blackstone to JP Morgan, venerable Wall Street firms have tokenized tens of billions worth of real world assets (RWAs).

In terms of legitimizing of blockchain technology in the world of payments, Visa has now started to support settlement services using stablecoins, across several blockchain platforms. All of these developments demonstrate how far crypto has come, but the future is still being written.

The Future is Still Being Written

In the span of fifteen years, what started as a fringe community has evolved into a fast-growing segment of the overall financial system. However, things are still in the early stages. Widespread institutional adoption remains a work in progress. The full integration will only be complete when tokenized assets become widespread, and a greater number of financial transactions are completed via blockchain.

Wall Street is entering the arena, but crypto-native operators have the advantage. Companies like Binance already have the scale, liquidity, and global infrastructure to lead the transition. “Old School” financial services companies are still making their respective crypto pivots, learning as they go, while crypto-native institutions like Binance continue building at full speed and expanding across global markets.

Still, this isn’t likely going to stop the merging of the crypto financial world with that of the fiat financial world. In the years ahead, expect the level of prominence among speakers at conferences like Binance Blockchain Week to continue hitting new levels of power, influence, and prestige.