Fox’s proposed accelerated share repurchase program, starting October 31, will cover both Class A and Class B shares.

- Fox’s proposed accelerated share repurchase program, starting October 31, will cover both Class A and Class B shares.

- The company posted Q1 2026 revenue of $3.74 billion and adjusted EPS of $1.51, beating analyst estimates.

- Fox’s Tubi division signed a multi-year exclusive distribution and ad sales deal with podcast network Audiochuck.

Fox Corp. (FOX, FOXA) on Thursday announced its plans to launch a $1.5 billion accelerated share repurchase program, effective Oct. 31, 2025, targeting both Class A and Class B common stock.

The media house also reported its first-quarter (Q1) 2026 earnings, as well as a multi-year exclusive distribution and advertising sales rights agreement with Audiochuck.

Share Repurchases So Far

As of Sept. 30, 2025, Fox had already repurchased roughly $5.85 billion in Class A stock and $1 billion in Class B shares, leaving $5.15 billion in authorization for future repurchases.

Under the latest plan, $700 million will be used to repurchase Class A shares, and $800 million will be allocated for Class B shares. The company anticipates that the transaction will be completed during the second half of fiscal 2026.

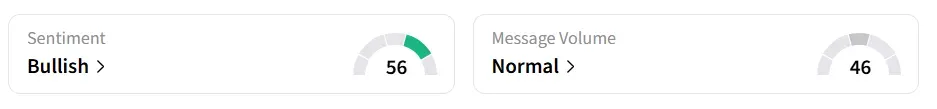

Fox Class A stock traded over 5% higher on Thursday morning. On Stocktwits, retail sentiment around the stock shifted to ‘bullish’ from ‘neutral’ territory the previous day. Message volume improved to ‘normal’ from ‘low’ levels in 24 hours.

Q1 Financial Performance

For the first quarter (Q1), Fox reported total revenue of $3.74 billion, representing a 5% year-over-year (YoY) increase. Adjusted earnings per share (EPS) totaled $1.51. Both revenue and EPS exceeded the analysts’ consensus estimate of $3.56 billion and $1.1, respectively, according to Fiscal AI data.

The company attributed the rise in revenue to steady growth in distribution and advertising, supported by stronger performance in its Cable Network Programming and Television segments.

Tubi’s Deal With Audiochuck

Fox’s division, Tubi Media Group’s partnership with Audiochuck grants Tubi exclusive distribution and advertising sales rights for Audiochuck’s top-charting titles, including Crime Junkie, The Deck, So Supernatural, Dark Downeast, and Park Predators.

Founded in 2017, Audiochuck has built a vast portfolio of more than 20 shows available on platforms such as Spotify Inc. (SPOT), Apple Inc. (AAPL), and YouTube.The collaboration aims to strengthen Fox’s streaming portfolio and expand Audiochuck’s multimedia reach.

Fox Class A stock has gained over 32% in 2025 and over 52% in the last 12 months.

For updates and corrections, email newsroom[at]stocktwits[dot]com.<