Philip D. Fracassa will succeed Patrick McCann, who will step down after a career spanning more than 26 years with Magna.

Magna International (MGA) said on Thursday that Philip D. Fracassa will succeed Patrick McCann as Executive Vice-President and Chief Financial Officer (CFO) of the company, effective immediately.

McCann will step down from the company after a career spanning more than 26 years with Magna, the company said, while adding that the outgoing executive will remain in an advisory role until the end of February to enable a smooth transition.

Fracassa previously served as Executive Vice President and CFO of The Timken Company since 2014, Magna said, adding that he brings extensive experience in the automotive and industrial sectors. He was also previously employed at automaker General Motors.

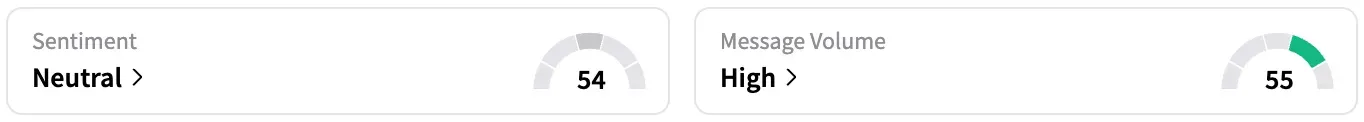

On Stocktwits, retail sentiment around MGA stock fell from ‘bullish’ to ‘neutral’ territory over the past 24 hours, while message volume rose from ‘normal’ to ‘high’ levels.

Fracassa’s appointment will be instrumental as the company delivers on its full-year outlook, the company said. Magna updated its full-year outlook in August and now expects total sales to be between $40.4 billion and $42 billion, and adjusted net income to be between $1.35 billion and $1.55 billion.

In the second quarter, the company’s sales decreased 3% to $10.6 billion, as light vehicle production declined by 6% and 2% in North America and Europe, respectively. Adjusted and diluted earnings per share, however, rose 7% in the quarter to $1.44.

Magna, the auto parts supplier, has about 164,000 employees across 338 manufacturing operations and 106 product development, engineering, and sales centres. The company’s results are dependent on light vehicle production by its customers, including Ford, GM, and Stellantis, in three key regions: North America, Europe, and China.

Shares of the company rose 10% this year and by about 17% over the past 12 months.

Read also: Maze Therapeutics Stock Just Shot Up 56% Pre-Market Today – Here’s What Happened

For updates and corrections, email newsroom[at]stocktwits[dot]com.<