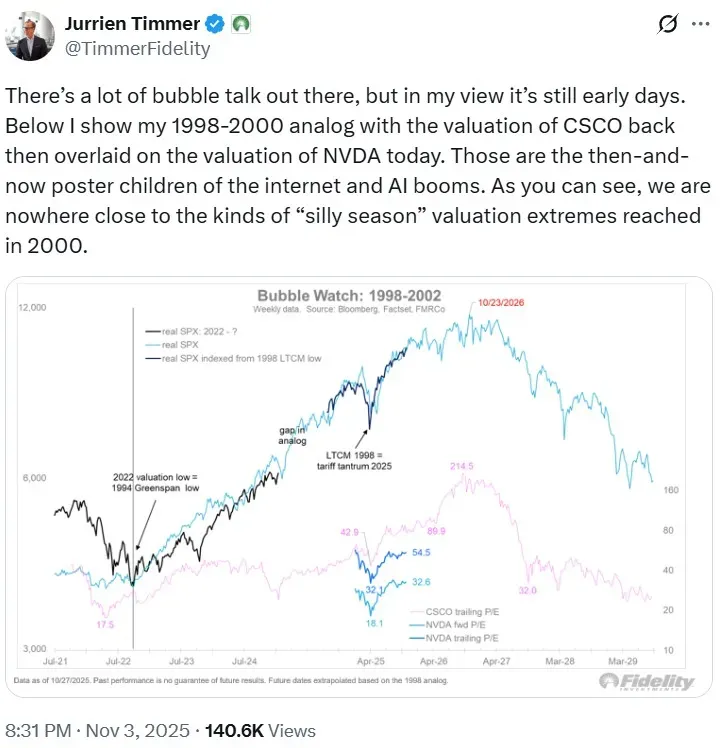

Timmer compared Nvidia’s valuations during the ongoing AI boom with those of Cisco, which was at the center of the dotcom bubble due to widespread adoption of the internet.

Jurrien Timmer, Director of Global Macro at Fidelity Investments, on Tuesday downplayed concerns of an AI bubble amid a surge in the valuation of Nvidia Corp. (NVDA).

Timmer compared Nvidia’s valuations during the ongoing artificial intelligence (AI) boom with those of Cisco Systems Inc. (CSCO), which was at the center of the dotcom bubble, facilitated by the widespread adoption of the internet.

“There’s a lot of bubble talk out there, but in my view it’s still early days,” Timmer said in a post on X, overlaying Nvidia’s valuations with those of Cisco. He compared Nvidia’s price-to-earnings (P/E) ratio with Cisco’s, showing that the AI bellwether’s trailing P/E ratio is still notably lower than that of Cisco.

Nvidia’s shares were down more than 2% in Tuesday morning’s trade. Retail sentiment on Stocktwits around the company was in the ‘extremely bullish’ territory at the time of writing.

Get updates to this story developing directly on Stocktwits.<

For updates and corrections, email newsroom[at]stocktwits[dot]com.<