Wells Fargo increased its price target on FedEx from $235 to $250, citing stronger-than-anticipated results, but acknowledged the revenue outlook as overly optimistic.

FedEx Corp. (FDX) received mixed signals from Wall Street analysts following its latest quarterly earnings report, with multiple firms adjusting their price targets based on the company’s performance and forward guidance.

The company’s first-quarter (Q1) fiscal 2026 revenue of $22.2 billion and adjusted earnings per share (EPS) of $3.83 both surpassed the analysts’ consensus estimate of $21.65 billion and $3.61 per share, respectively, according to Fiscal AI data.

FedEx said it expects to take a $1 billion hit due to global trade uncertainty and has set a goal of achieving $1 billion in cost savings for fiscal year 2026, with a target revenue growth rate of 4% to 6%.

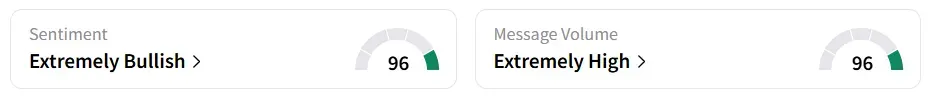

FedEx stock traded over 3% higher in Friday’s premarket. On Stocktwits, retail sentiment around the stock remained in ‘extremely bullish’ territory amid ‘extremely high’ message volume levels.

The stock experienced a 900% surge in user message count in 24 hours.

Wells Fargo bumped up its price target on FedEx from $235 to $250 but kept an ‘Equal Weight’ rating. The firm acknowledged stronger-than-anticipated results and revised its estimates higher. However, it remains cautious, noting that the company’s revenue outlook may be too optimistic. While FedEx appears to be performing well in a challenging environment, Wells stated it is keeping its EPS estimate slightly below the consensus.

Meanwhile, Stifel lowered its price target on the stock to $296 from $308 but maintained a ‘Buy’ rating. The firm highlighted the strength of FedEx’s Q1 adjusted earnings as a sign that Network 2.0, its operational overhaul, is delivering tangible results.

The firm believes this may be a turning point for investor sentiment, which could start to shift more positively if the momentum continues. In contrast, Susquehanna raised its price target to $300 from $285 and reiterated a ‘Positive’ rating. The firm noted that the full-year adjusted EPS guidance exceeded both its own revised projections and buy-side expectations.

However, it cautioned that the company’s limited operating leverage, despite higher revenues, is worth monitoring.

For updates and corrections, email newsroom[at]stocktwits[dot]com.<