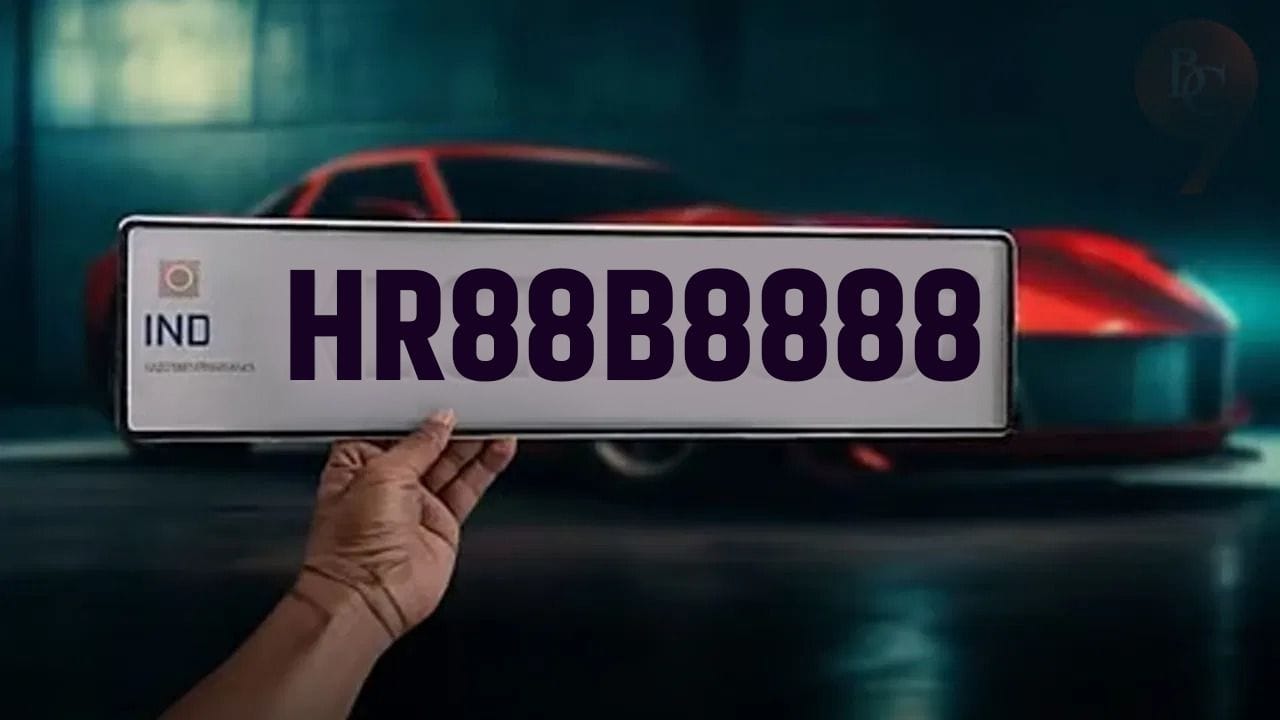

number plate

In India, cars are no longer just a means of transportation, but have become a major symbol of pride, status and fame. With the launch of new models, another craze is increasing rapidly among the people. Fancy number plate. This craze created a new history in Haryana’s online auction, where number HR88B8888 broke all records and fetched a bid of Rs 1.17 crore. This has now become the most expensive number plate in the country. But the real question is, how much tax will the person buying such an expensive number plate have to pay?

Will a fancy number be considered a luxury item?

At present, different taxes are levied on fancy numbers in many states of the country. At some places only registration fee is charged, while at some places 18% GST is applicable. However, now the government is preparing to include it directly in the luxury category. According to the proposal, 28% GST can be imposed on fancy number plates. This means that the tax on the number plates which are being sold for crores is going to be equally heavy.

How much tax will be charged on number plate worth Rs 1.17 crore?

If this proposal of the government is implemented, then 28% GST will be directly applicable on Rs 1.17 crore. That is, the buyer must pay:

1.17 crore × 28% = approximately Rs 32.76 lakh GST

This means that you will have to pay more than Rs 30 lakh in tax alone. Considering this auction amount as luxury payment, the government is considering imposing full GST on it.

What is the situation now?

At present, 18% GST is already being imposed in many states, but the tax structure is not the same everywhere. To eliminate this inequality, the Finance Ministry has been asked to make clear rules, so that it can be officially included in the 28% slab.

Fancy number without permission? heavy fine fixed

The government has also made it clear that installing fancy number plates without permission or without auction is against the rules. Doing so may result in heavy fine under the Motor Vehicle Act. That is, if a plate is installed without authorization in order to look unique or stylish, it will be considered a direct violation of the law.

What can change in the coming days?

If 28% GST is implemented, fancy numbers will become further away from common people. Paying tax of lakhs after bidding worth crores is not within everyone’s reach. Experts believe that this step could be part of the government’s policy to control luxury items. Overall, fancy number plates are going to become more exclusive in the coming times and buying them will remain a rich class luxury.

This is how VIP numbers are bid

Bidding for VIP numbers of vehicles in the state is done online. Every Friday from 5 pm to Monday 9 pm, interested persons choose the number of their choice and apply. After this, online bidding continues till 5 pm on Wednesday. Its result is declared on the same day.