The firm reaffirmed a ‘Sell’ rating on the uranium miner and set a price target of $11.50, citing valuation concerns.

- Roth pointed to expectations around Energy Fuels’ rare earth element initiatives as a factor contributing to an inflated share price relative to its core uranium operations.

- On Monday, Energy Fuels said it surpassed its uranium production expectations in 2025.

- Roth Capital is unconvinced that these operational gains materially shift the long-term earnings trajectory.

Energy Fuels (UUUU) beat uranium production forecasts, raised sales expectations, and extended a strong rally but Roth Capital remains unconvinced. It believes that the stock is still priced for more than its core operations can support.

The firm reaffirmed a ‘Sell’ rating on the uranium miner and set a price target of $11.50, citing valuation concerns tied to the company’s broader strategic outlook, according to TheFly.

Valuation Concern

The firm pointed to expectations around Energy Fuels’ rare earth element initiatives as a factor that contributes to an inflated share price relative to core uranium operations, even though recent results showed production and sales above internal forecasts.

On Monday, Energy Fuels said it surpassed its uranium production expectations in 2025, mining more than 1.6 million pounds from its Pinyon Plain Mine in Arizona and the La Sal Complex in Utah, about 11% above the high end of its guidance.

Nevertheless, Roth Capital’s valuation methodology, which includes a sum-of-the-parts assessment, leaves the firm unconvinced that these operational gains materially shift the long-term earnings trajectory.

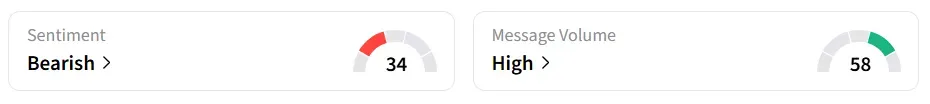

Energy Fuels’ stock inched 0.7% higher in Tuesday’s premarket. On Stocktwits, retail sentiment around the stock remained in ‘bearish’ territory while message volume shifted to ‘high’ from ‘low’ levels in 24 hours.

Sales Outlook

Energy Fuels now plans to sell about 360,000 pounds of triuranium octoxide in the fourth quarter (Q4) of 2025. That amount is more than twice what the company previously forecast and about 50% higher than sales in the third quarter of 2025. The company expects these sales to generate roughly $27 million in gross uranium revenue in Q4.

Energy Fuels produces critical materials, including uranium, rare earth elements, heavy mineral sands, vanadium, and medical isotopes. It operates multiple uranium projects across the western U.S. and has been supplying nuclear utilities that generate carbon-free energy.

UUUU stock has gained over 193% year-to-date.

For updates and corrections, email newsroom[at]stocktwits[dot]com.<