In a post on X, he described the volatility as atypical for the central bank, which traditionally aims for “predictability and stability.”

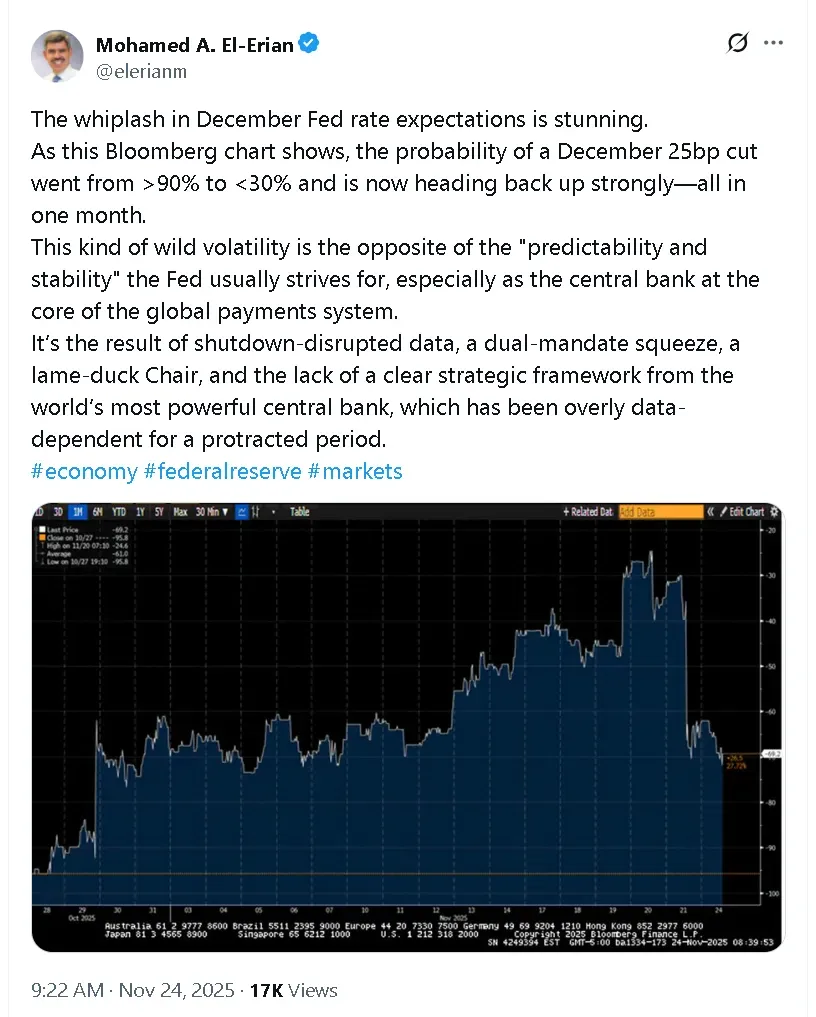

Mohamed El-Erian, Chief Economic Advisor at Allianz, said on Monday that U.S. markets have experienced a “whiplash” in expectations for the Federal Reserve’s December interest rate decision.

In a post on X, he described the volatility as atypical for the central bank, which traditionally aims for “predictability and stability,” given the Fed’s role in the global payments system.

El-Erian attributed the erratic market swings to a combination of factors. “It’s the result of shutdown-disrupted data, a dual-mandate squeeze, a lame-duck Chair, and the lack of a clear strategic framework from the world’s most powerful central bank, which has been overly data-dependent for a protracted period,” he wrote.

U.S. equities traded higher during Monday morning. The SPDR S&P 500 ETF (SPY) was up 0.98%, the SPDR Dow Jones Industrial Average ETF (DIA) gained 0.30%, and the Nasdaq-100 tracking Invesco QQQ Trust (QQQ) moved 1.70% higher. Retail sentiment around QQQ on Stocktwits improved to ‘neutral’ from ‘bearish’ territory over the past day, accompanied by ‘high’ levels of chatter.

Get updates to this developing story <directly on Stocktwits.<

Read also: Bitcoin Holds $86,000 With Crypto Market Back Above $3 Trillion – XRP, Doge Gain Ahead Of Grayscale’s New ETF Launches

For updates and corrections, email newsroom[at]stocktwits[dot]com.<