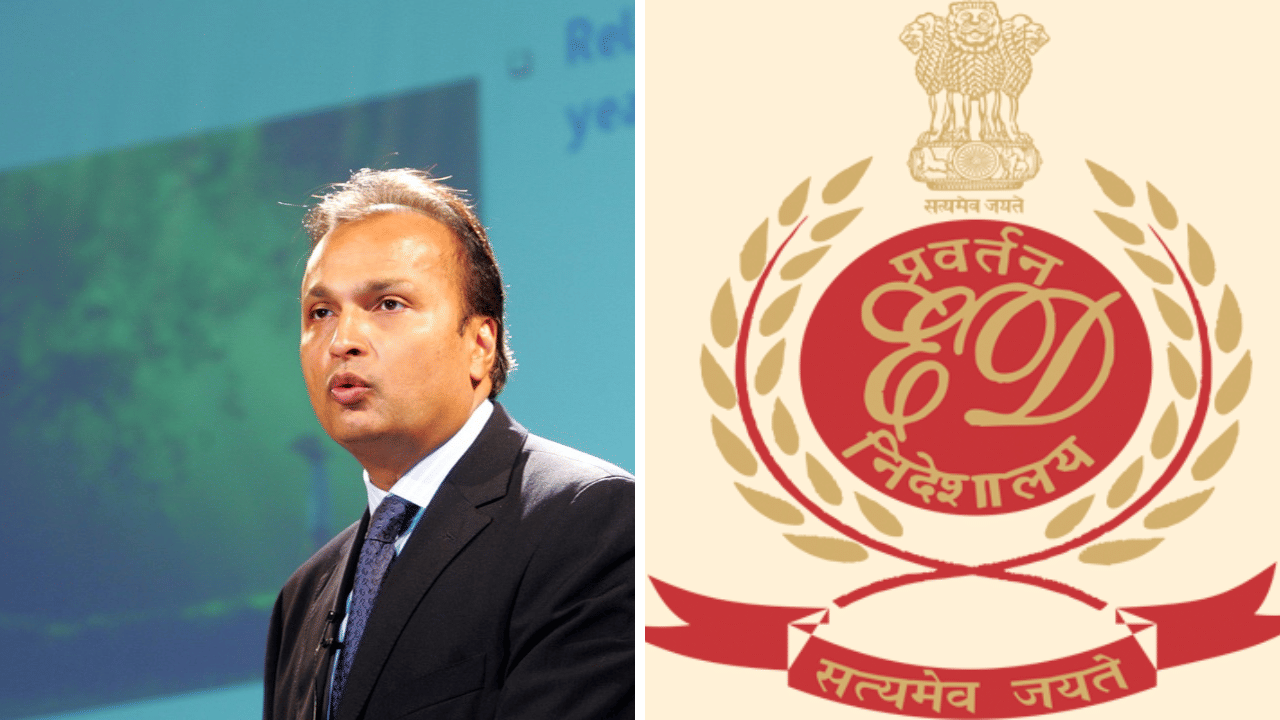

New Delhi: The Enforcement Directorate (ED) has taken major action against industrialist Anil Ambani’s properties associated with Reliance Group. This action is worth more than Rs 3,084 crore, which has been temporarily attached. The ED took this step under the Prevention of Money Laundering Act (PMLA) on 31 October 2025.

The list of properties that have been seized is quite long. This includes the posh Pali Hill house in Bandra, Mumbai and the main Reliance Center in Delhi. Besides this, many land, offices and flats located in major cities like Delhi, Noida, Ghaziabad, Mumbai, Pune, Thane, Hyderabad, Chennai, Kanchipuram and East Godavari have also been attached. In total, more than 40 properties belonging to the Anil Ambani Group have been subjected to this action.

Anil Ambani’s properties worth Rs 3084 crore attached

The Directorate of Enforcement (ED) has provisionally attached properties worth about Rs 3,084 crore linked to entities of the Reliance Anil Ambani Group. The orders were issued on 31 October 2025 under Section 5 (1) of the Prevention of Money Laundering Act (PMLA).

The focus of ED’s investigation is Reliance Group’s two financial companies—Reliance Home Finance Ltd (RHFL) and Reliance Commercial Finance Ltd (RCFL). According to the investigation, these companies are accused of misusing the money collected from the general public and banks.

This happened between 2017 and 2019. During this period, Yes Bank had made a huge investment of around Rs 2,965 crore in RHFL and Rs 2,045 crore in RCFL. These investments later sank, leaving the arrears of thousands of crores of rupees on these two companies.

The investigation also revealed that in violation of the rules of the Securities and Exchange Board of India (SEBI), public money deposited through mutual funds was indirectly transferred to Reliance Group’s own companies. The funds were diverted and invested in these companies through Yes Bank.

The ED alleges that a thoughtful plan was prepared for this fund diversion. The agency has cited several serious irregularities.

The Directorate of Enforcement (ED) has provisionally attached properties worth about Rs 3,084 crore linked to entities of the Reliance Anil Ambani Group. The orders were issued on 31 October 2025 under Section 5(1) of the Prevention of Money Laundering Act (PMLA).

The attached… pic.twitter.com/3NxjxycurC

— ANI (@ANI) November 3, 2025

Diversion of corporate loans: Corporate loans taken by companies have been sent to other companies of their own group.

Violation of procedures: Many loans were sanctioned without any proper documentation, thorough scrutiny, and in a single day.

Advance payments: There were some cases where money was disbursed to the borrower even before the loan was sanctioned.

Weak borrowers: Many debtors were companies whose financial position was already weak.

Deviation from purpose: The loan was not used for the purpose for which it was taken.

ED claims that this was a massive fund diversion.

Screws tightened in RCom case

Apart from this, ED has also intensified its investigation into the matter related to Reliance Communications (RCom). In this case too, companies have been accused of misusing more than Rs 13,600 crore, in which a large sum of money was sent to group companies and the loan was kept running fraudulently. ED says that this action will play an important role in the recovery of public funds, because this money belongs to the general public and financial institutions.