- DraftKings acquires prediction markets exchange Railbird for an undisclosed sum.

- Shares rise over 4% in after-hours trading; they have declined over 9% year-to-date.

- The deal gives DraftKings an entry into the increasingly popular space and potential new revenue streams.

DraftKings, Inc.’s stock jumped over 4% after-hours and was among the top trending on Stocktwits late Tuesday. The gaming company announced the acquisition of Railbird, an exchange for trading event-based contracts, marking its entry into the prediction markets business.

Prediction Markets Betting In Demand

Services that allow consumers to bet on real-world events, such as the outcomes of sporting contests, elections, and financial events like the release of economic data, have gained attention recently. Kalshi, a leading player in prediction markets, recently raised $300 million at a $5 billion valuation, while Robinhood’s stock has surged on the back of its event-contracts launch in partnership with Kalshi.

That initially put iGaming players, such as DraftKings and FanDuel operator Flutter Entertainment, at a perceived risk. Investors dumped their stocks over concerns that the rise of prediction markets would cannibalize the user base for sports betting and fantasy sports. However, some analysts have said those concerns are overblown.

Upside For DraftKings

Entry into prediction markets and event-based contracts has another advantage: companies offering these services, including Railbird, are regulated by the Commodity Futures Trading Commission, allowing them to operate in states where sports betting is banned.

If DraftKings offers sports events contracts, it’s likely to focus only on states that don’t offer licensed sports betting, like California and Texas.

“We are excited about the additional opportunity that prediction markets could represent for our business,” DraftKings CEO Jason Robins said in a statement, announcing the acquisition.

“We believe that Railbird’s team and platform—combined with DraftKings’ scale, trusted brand, and proven expertise in mobile-first products—positions us to win in this incremental space.”

Retail Confidence For DKNG Improves

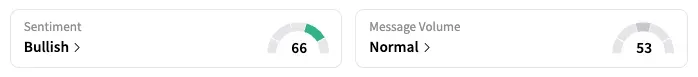

On Stocktwits, the retail sentiment for DNKG shifted to ‘bullish’ as of late Tuesday, from ‘bearish’ the previous day.

“$DKNG this acquisition deserves a 20%+ move in my opinion,” said one user. “Considering how the stock is also extremely undervalued. New verticals will be added, numbers have already been strong.”

As of last close, DraftKings’ shares are down 9.6% year-to-date.

For updates and corrections, email newsroom[at]stocktwits[dot]com.<