Investors and analysts have raised concerns that Kalshi and other prediction market plays could eat into a segment of the business of sports betting players like DraftKings.

DraftKings shares rose 2% in premarket trading on Thursday, signaling a rebound from the steep drop seen in recent sessions due to worries about the competitive threat posed by prediction-market startup Kalshi.

The stock has fallen for seven straight sessions. It declined by over 25% so far this week, which is shaping up to be the worst week in three years.

The decline comes as Kalshi, which allows users to trade contracts on real-world outcomes such as economic data, politics, and sports, reported a record trading volume over the weekend, largely due to the NFL and college football games.

Meanwhile, Robinhood’s stock is trading at a record high, primarily attributed to increased activity in prediction market services through its partnership with Kalshi.

This has alarmed investors, who worry that Kalshi and other prediction market plays could begin to eat into DraftKings’ sports betting market share. Shares of Flutter Entertainment, which runs DraftKings rival FanDuel, have declined 10% this week.

Jefferies recently noted that sports betting and Kalshi’s event-outcome contracts are distinct products, and the latter’s rise would only make a “little dent” in Flutter’s market share. Consumers prefer breadth and depth of parlays across various markets, games, and sports, the research firm had said.

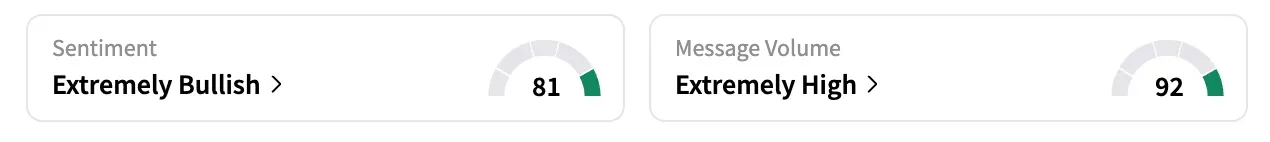

On Stocktwits, the retail sentiment for DraftKings stock climbed multiple notches higher in the ‘extremely bullish’ zone, compared to the prior day. User reactions were mixed, though several highlighted a notable upside driver: Cathie Wood’s Ark Investment purchasing 511,000 DraftKings shares on Wednesday.

Year-to-date, DKNG shares are down 5.5%.

For updates and corrections, email newsroom[at]stocktwits[dot]com.<