The proposed settlement, filed by the department and its state co-plaintiffs, would require UnitedHealth and Amedisys to divest 164 home health and hospice locations, including one affiliated palliative care facility, across 19 states.

The Justice Department’s Antitrust Division said on Thursday that it requires broad divestitures to resolve the challenge to UnitedHealth Group Incorporated’s (UNH) planned $3.3 billion acquisition of home health and hospice services provider Amedisys Inc. (AMED).

The proposed settlement, filed by the department and its state co-plaintiffs, would require UnitedHealth and Amedisys to divest 164 home health and hospice locations, including one affiliated palliative care facility, across 19 states, accounting for approximately $528 million in annual revenue. The locations are spread across Tennessee, Alabama, Georgia, South Carolina, Virginia, Pennsylvania, New York, West Virginia, and Mississippi, among others.

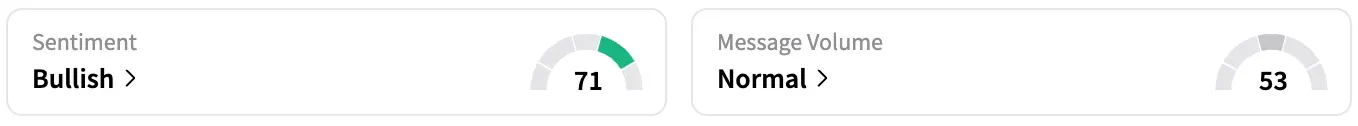

The settlement would secure the largest divestiture of outpatient healthcare services to resolve a merger challenge by the number of facilities, the department said. On Stocktwits, retail sentiment around UNH fell from ‘extremely bullish’ to ‘bullish’ territory over the past 24 hours, while message volume stayed at ‘high’ levels.

Retail sentiment around Amedisys trended in the ‘bullish’ territory, accompanied by ‘normal’ levels of retail chatter.

A Stocktwits user opined that the divestitures may reduce expected synergies.

Additionally, the department requires Amedisys to pay a $1.1 million civil penalty and train its corporate and field leadership on antitrust compliance for falsely certifying that the company had truthfully, correctly, and completely responded to the United States’ requests for documents.

UNH’s Optum unit submitted a proposal to acquire Amedisys in June 2023. UNH had acquired Amedisys’s rival LHC Group earlier that year through a $5.4 billion deal. However, the U.S. Department of Justice and attorneys general from four U.S. states filed a lawsuit in November 2024 to block the acquisition.

“Eliminating the competition between UnitedHealth and Amedisys would harm patients who receive home health and hospice services, insurers who contract for home health services, and nurses who provide home health and hospice services,” the department then said.

While shares of UNH are down by 52% this year, AMED is up by 11%.

Read also: This Pharma Stock Shot Up 8% Today, Gets A Price Target Hike From Wells Fargo: Here’s Why Retail Sees Opportunity

For updates and corrections, email newsroom[at]stocktwits[dot]com.<