The analyst sees the acquisition as a smart step toward strengthening its smartphone, IoT, and automotive segments.

Dixon Technologies shares gained 1% on Thursday after the company signed a deal to acquire a 51% stake in Kunshan Q Tech Microelectronics India for about ₹553 crore. The agreement includes a share purchase worth ₹125 crore.

Q Tech India is a key player in camera and fingerprint modules, supplying to fast-growing verticals such as smartphones, IoT devices, and the automotive sector.

SEBI-registered investment advisor Nidhi Saxena of Trade Bond said that this acquisition was strategically positive and can lift sentiment in the short term for Dixon Technologies. However, execution, integration, and funding impact will decide its sustainability over the medium term.

She called it a ‘smart move’ for Dixon because it broadens their product portfolio and opens opportunities in smartphones, IoT, and auto electronics.

Why This Deal Matters For Dixon?

Saxena highlighted that this deal strengthens backward integration in components manufacturing. It also helps Dixon expand its presence in the high-growth, high-margin electronics segments, positioning it for better government PLI opportunities and capitalising on the ‘Make in India’ demand.

According to her, at the current market price, there may be short-term upside on positive sentiment, but real value will emerge if Dixon delivers seamless integration and margin expansion.

Brokerages Optimistic On Dixon

In a brokerage note in August, Motilal Oswal maintained a ‘Buy’ call on Dixon Tech, owing to its market leadership positioning, joint ventures with other players that ensure long-term sustainability of volumes, backward integration, and ability to scale up other segments such as telecom, IT hardware, refrigerator, etc.

Dixon holds 19% volume market share in the smartphone market in FY25, moving up to 40% by FY27-end.

What Is The Retail Mood?

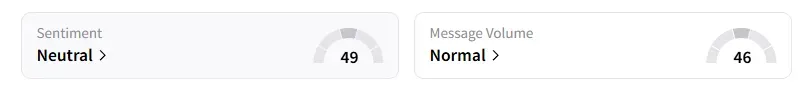

Data on Stocktwits shows that retail sentiment has moved from ‘bearish’ last week to ‘neutral’ a day ago.

Dixon Technologies has risen only 2% year-to-date (YTD).

For updates and corrections, email newsroom[at]stocktwits[dot]com.<