BEL has outperformed the broader market with a 50% rise this year. The analyst recommends accumulating on dips near ₹400.

As we head into the festive Diwali season, investors are looking for stock picks to boost their portfolios over the next year. One such investment idea for Samvat 2082 comes from the defense sector, which has been an outperformer this year.

Bharat Electronics (BEL), a Navratna PSU under the Ministry of Defence, is SEBI-registered analyst Deepak Pal’s Diwali 2025 pick. He expects over 40% upside potential in this defense multi-bagger by next Diwali.

The stock has delivered exceptional returns in the past 10 months, moving from around ₹265 to ₹415 — a remarkable gain of about 50%. The stock is forming higher highs each month, with its price action and technical structure strongly reinforcing its uptrend.

Pal said that after Operation Sindoor, BEL has been a prime beneficiary of India’s defence indigenisation and rapid contract approvals, receiving record orders, especially during June–September 2025. With healthy financials, robust margins, and a massive order book, BEL remains a formidable compounding opportunity for investors looking for growth and stability.

He added that any dip near the ₹400 levels should be considered as an opportunity to accumulate. Long-term investors can hold the stock, which has a potential upside of gains to ₹600, by next Diwali (2026).

Year-on-Year Stock Performance

2020: ₹105–₹130 (Covid lows and market rebound)

2021: ₹150–₹200 (+51% driven by sector recovery)

2022: ₹190–₹230 (+15% on rising defence orders)

2023: ₹240–₹295 (+28%, solid order pipeline)

2024: ₹298–₹399 (+34%, accelerated inflows)

2025 (YTD): ₹400–₹415 (+41% annualized; a remarkable 250% gain in five years)

Technical Forecast

On the medium-term technical charts, Pal flagged that its monthly Relative Strength Index (RSI) is in a bullish zone. If ₹400 base holds, the next resistance is seen at ₹475. A breakout above that can carry it to ₹600 by Diwali 2026.

He advised traders to use any potential corrections toward the ₹370–₹350 zone for staggered buying.

Pal believes that if BEL continues its strong execution pace, maintains margins above 20%, and secures more government and export orders, investors can expect 15–20% annualized returns over the next 2–3 years. However, future returns are contingent upon defense budget allocations, global geopolitical stability, order execution, and cost efficiency.

Investment Recommendation

Rating: Strong Accumulate/Buy-on-Dips

1-Year Target: ₹600

Accumulation Zone: ₹375–₹415

Strategy: Any sharp correction or consolidation should be considered for staggered buying. On sustained closing above ₹475, the uptrend is likely to accelerate.

Triggers To Watch

Q2 results are scheduled for October 31, and investors will be watching for updates on order inflow, margin expansion, and the dividend payout.

What Is The Retail Mood?

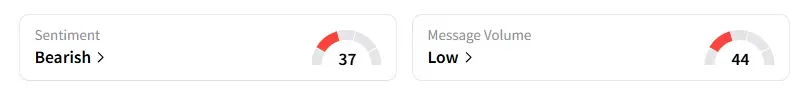

Data on Stocktwits showed that retail sentiment has been ‘bearish’ for a week now.

BEL shares have rallied 40% year-to-date (YTD).

Disclaimer: The views and opinions expressed are those of the SEBI-registered analyst/advisor mentioned in the article, and are not endorsed by Stocktwits. This is not investment advice. Please do your own research or consult a financial advisor.<

For updates and corrections, email newsroom[at]stocktwits[dot]com.<