Daiwa Securities has reportedly projected losses in the company’s international business.

- Daiwa Securities said Didi flagged higher investments in Latin America, particularly its food delivery business in Brazil.

- The research has projected quarterly losses for Didi and reduced its EPS target for the company.

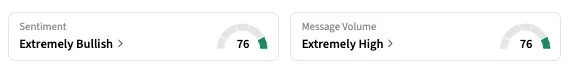

- Stocktwits sentiment for DIDIY, however, flipped to ‘extremely bullish’ from ‘bearish.’

U.S.-listed shares of Chinese ride-hailing giant DiDi Global, Inc. drew attention on Stocktwits early Thursday after four consecutive sessions of losses totaling 22.5%.

In an investor note, Daiwa Securities highlighted potentially larger-than-expected international losses in the third and fourth quarters, driven by the company’s investments in its food delivery business in Brazil, causing investors to react to the hit in profitability.

Third-quarter loss in Didi’s international business is estimated to be between 1.7 billion yuan and 1.8 billion yuan ($238 million to $252 million), with Q4 potentially exceeding 2 billion yuan, according to a report based on the note on aastocks.com, a Hong Kong-based financial news platform.

That’s after the company recently held a conference call previewing its results, which reportedly spooked investors with details of elevated spending in Latin America.

Daiwa, consequently, lowered its 2025-2027 EPS forecasts for DiDi Global by 24% to 37% and cut its price target on the stock to $7.5 to $7, while maintaining a ‘Buy’ rating.

On Stocktwits, the retail sentiment flipped to ‘extremely bullish’ as of early Thursday, from ‘bearish’ the previous day, with ‘extremely high’ message volume.

“$DIDIY usually when it goes down that fast majority of the time there was a big rise in the share price in the weeks later. Let’s hope that this is the case,” said one user.

Year to date, the DIDIY stock has gained 13.8%.

For updates and corrections, email newsroom[at]stocktwits[dot]com.<