On Thursday, Delta reported earnings per share (EPS) of $1.71 on revenue of $16.67 billion, beating analyst estimates of $1.53 on revenue of $15.08 billion.

Delta Air Lines (DAL) stock edged higher in premarket trading on Friday, eyeing gains for the second consecutive session after its upbeat third-quarter earnings.

On Thursday, Delta reported earnings per share (EPS) of $1.71 on revenue of $16.67 billion, beating analyst estimates of $1.53 on revenue of $15.08 billion, according to Stocktwits data.

According to TheFly, Deutsche Bank raised the firm’s price target to $72 from $63 and kept a ‘Buy’ rating.

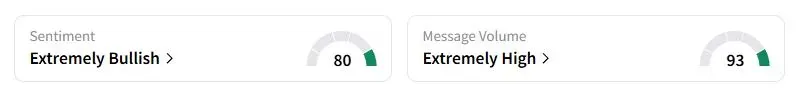

The firm brokerage reportedly viewed the company’s free cash flow generation, nearly $2 billion in debt paydown, “meaningful” product and service investments, and a dividend, bolstering the investment case. Retail sentiment on Stocktwits about Delta was in the ‘extremely bullish’ territory at the time of writing.

“Welcoming [$]70s. This will steadily head there. No way this will sit at [$]60,” one user wrote.

In the third quarter, the demand at the front of the plane continued to exceed bookings for the back half. Revenue from the high-end segment, encompassing first class and more spacious economy seating, rose by 9% to almost $5.8 billion. Conversely, main cabin revenue experienced a 4% decline, settling at about $6 billion.

Revenue from the premium segments could surpass sales from the economy seats at the back of the plane for at least a quarter or two next year, Delta executives said during a post-earnings conference call.

Delta Air Lines CEO Ed Bastian told CNBC that the carrier’s operation is running smoothly despite the federal government shutdown, but if the shutdown continues for another 10 days, that could change. He also warned that the shutdown was putting strain on air traffic control workers, an issue that has already been plaguing U.S. airlines over the past few years.

Delta stock has fallen 1.1% this year.

For updates and corrections, email newsroom[at]stocktwits[dot]com.<