The brokerage maintained its ‘Buy’ rating on the stock and set a street-high price target of $158.

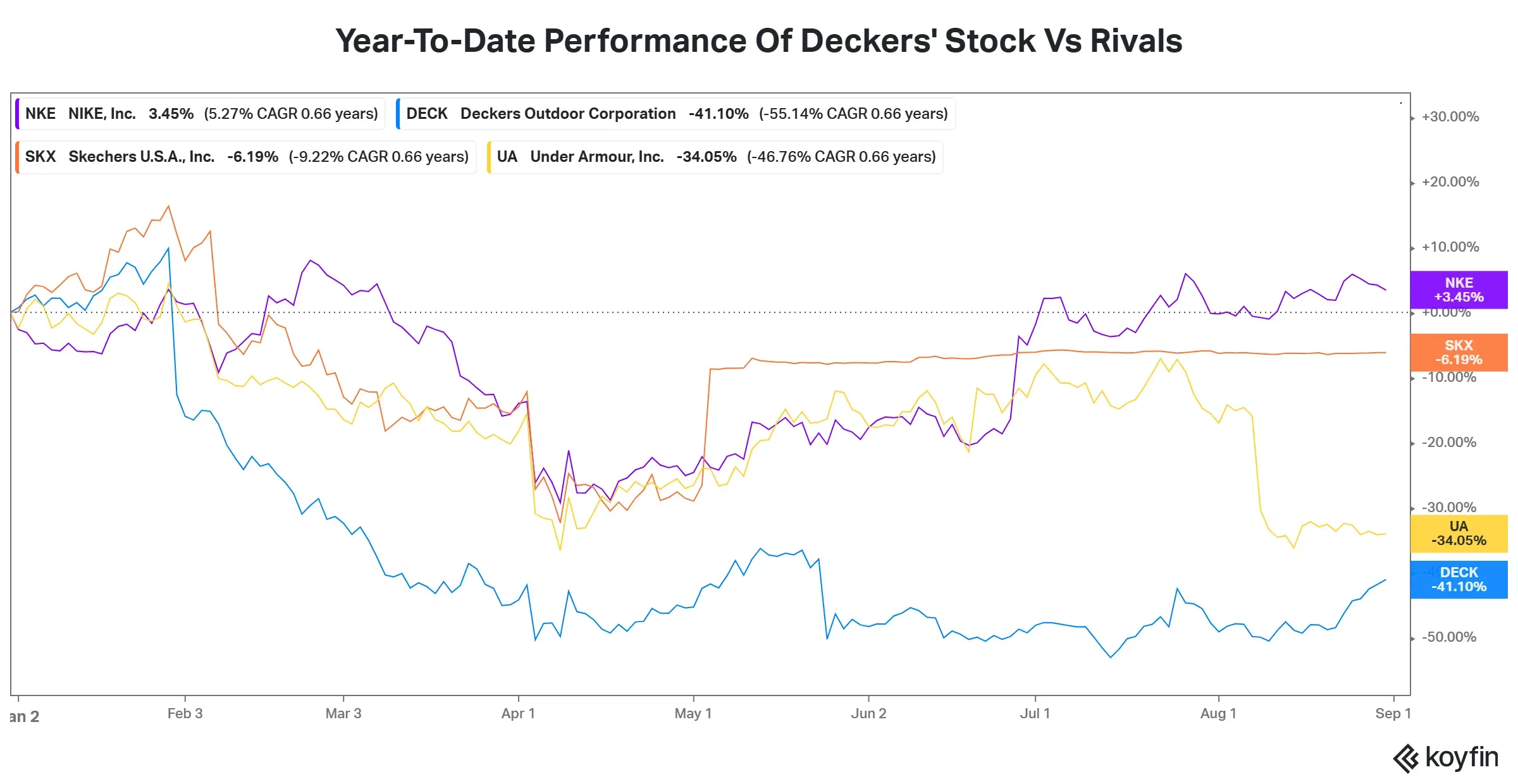

Deckers Outdoor edged lower in premarket trading on Tuesday, and a Wall Street firm feels the time may be ripe to go bottom-fishing.

UBS analyst Jay Sole believes that it may be the best time to buy the shares of the footwear seller after a brutal sell-off this year. According to a CNBC report, the brokerage maintained its ‘Buy’ rating on the stock and set a street-high price target of $158, which implies a close to 32% upside compared to the stock’s previous closing price.

According to Fiscal.ai data, the stock has a consensus price target of $129.28.

The Hoka sneaker-maker has suffered from a slowdown in sales growth in the U.S., which has weighed on its shares. It has now resorted to wider spacing between significant franchise launch dates and stricter inventory controls on outgoing models ahead of product refreshes.

Retail sentiment on Stocktwits about Decker’s was in the ‘bullish’ territory at the time of writing.

“We see a very good opportunity to buy shares in a growth company currently significantly undervalued by the market,” Sole reportedly wrote. “We currently model FY28 EPS of $7.90 but now see a greater probability our $10.00 upside case plays out.”

“Solid $120’s next week. Should hopefully settle into the mid $120’s to $130’s range until next earnings, unless a surprise news release or economic data throws a surprise curveball at us. Bullish and Long!” one user had written on Stocktwits.

For updates and corrections, email newsroom[at]stocktwits[dot]com.<