Ives’ suggestions for Apple involve an acquisition, a partnership, and looking beyond the company to manage its AI efforts.

Tech bull Dan Ives on Friday outlined three moves that Apple Inc. (AAPL) needs to make to avoid a “BlackBerry moment” in artificial intelligence (AI), after the Tim Cook-led company lost talent to Mark Zuckerberg-led Meta Platforms Inc. (META) over the past few weeks.

Ives’ suggestions for Apple involve an acquisition, a partnership, and looking beyond the company to manage its AI efforts, according to a post by the Wedbush Managing Director on X.

Apple’s shares traded 0.49% higher in Friday’s pre-market session. Stocktwits data showed the retail sentiment around the company on the platform was in the ‘bullish’ territory.

According to Ives, Apple needs to begin by acquiring private AI startup, Perplexity AI, before it’s too late. Based out of San Francisco, Perplexity AI is a free artificial intelligence-powered answer engine that allows users to choose from multiple AI models to address their questions.

The second item on Ives’ list is hiring external talent to lead Apple’s AI efforts. This comes after the iPhone maker was hit by a string of departures of top researchers to rivals like Meta, OpenAI, and xAI, among others. Ives also wants Apple to team up with Alphabet Inc.’s (GOOG) (GOOGL) Google to integrate the company’s AI model, Gemini, on iPhones.

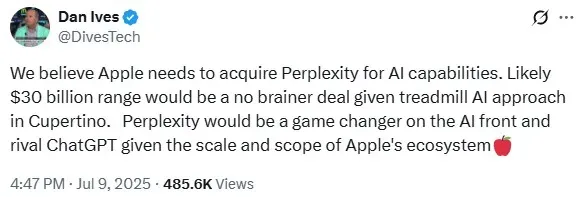

This is not the first time Ives has urged Apple to acquire Perplexity. Earlier in June, the tech bull called it a “no-brainer deal” for the iPhone maker, in a post on X.

“We believe Apple needs to acquire Perplexity for AI capabilities. Likely $30 billion range would be a no brainer deal given treadmill AI approach in Cupertino. Perplexity would be a game changer on the AI front and rival ChatGPT given the scale and scope of Apple’s ecosystem,” he said.

AAPL stock has declined more than 12% year-to-date, but it is up 3% over the past 12 months.

For updates and corrections, email newsroom[at]stocktwits[dot]com.<