Crypto-linked stocks traded unevenly overnight following a broad selloff, with some names attempting to stabilize while larger players remained under pressure.

- Robinhood, Bitmine Immersion Technologies (BMNR), and Circle (CRCL) posted modest after-hours gains.

- Meanwhile, Coinbase, Strategy, and MARA extended earlier losses, reflecting continued pressure on larger crypto-linked names.

- BlackRock expanded further into Ethereum by launching its BUIDL fund on Uniswap and purchasing UNI tokens, sending UNI price sharply higher before it pared gains.

Crypto-linked stocks traded unevenly in overnight action on Wednesday, with a handful of names attempting to stabilize after a sharp selloff while larger players remained under pressure.

Robinhood (HOOD), Bitmine Immersion Technologies (BMNR) and Circle Internet Group (CRCL) edged higher after closing in the red. By contrast, Strategy (MSTR), Coinbase (COIN) and MARA Holdings (MARA) extended their declines, though losses were modest.

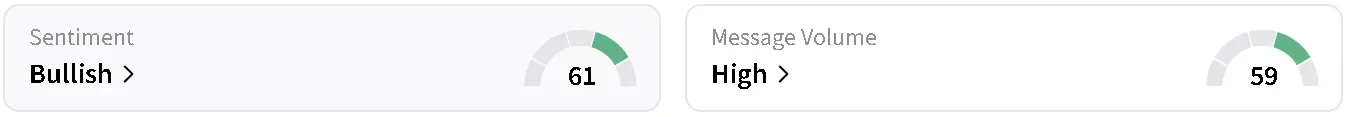

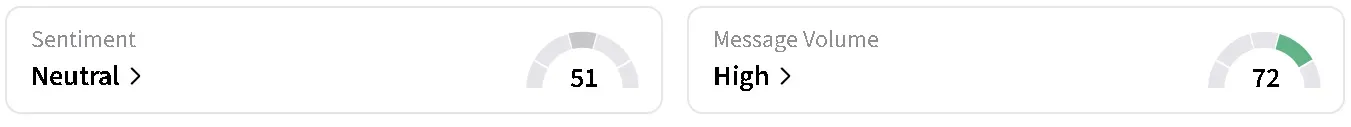

Bitcoin (BTC) continued to be volatile, climbing back above $67,00 on Wednesday night, but still down 0.06% in the last 24 hours. Coinglass data showed that traders took hits on both long and short bets as liquidations neared $300 million. Retail sentiment around the apex cryptocurrency on Stocktwits, however, flipped to ‘bullish’ from ‘bearish’ over the past day, accompanied by chatter at ‘high’ levels.

HOOD Stock’s Slide Continues Following Earnings Miss

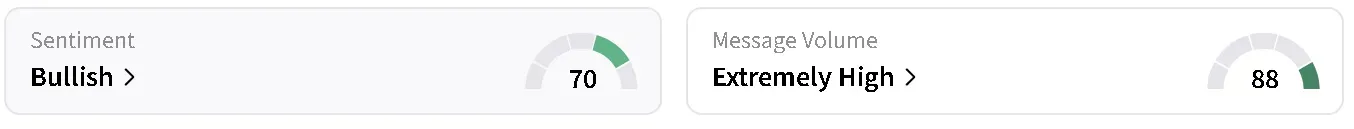

HOOD’s stock took one of the worst hits among crypto names in regular trade, down 8.91%, extending losses after its earnings missed Wall Street’s expectations. The stock edged 0.04% higher in overnight trade after Cathie Wood’s ARK Invest added some of Robinhood’s shares to its portfolios. On Stocktwits, retail sentiment around the company fell to ‘bullish’ from ‘extremely bullish’ over the past day, though chatter remained at ‘extremely high’ levels.

Bitmine and Circle Tick Stocks Tick Higher After Session Losses

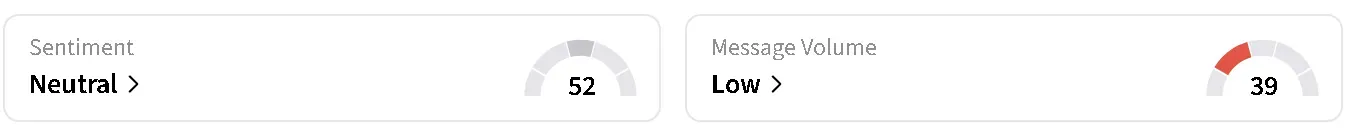

BMNR’s stock edged 0.31% higher in after-hours trade following a dip of 2.41% during the regular session. On Stocktwits, retail sentiment around the Ethereum (ETH)-backed digital asset treasury (DAT) improved to ‘neutral’ from ‘bearish’ territory, but chatter fell to ‘low’ from ‘normal’ levels.

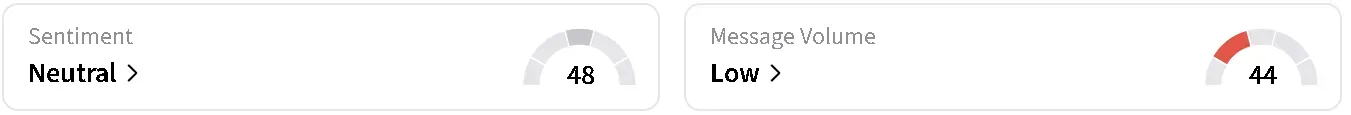

Circle was also on Ark Invest’s buy list on Wednesday. It added both stocks to its ARK Innovation ETF (ARKK), ARK Next Generation Internet ETF (ARKW), and ARK Fintech Innovation ETF (ARKF). CRCL’s stock rose moved 0.22% higher after hours following a drop of 3.16% in regular trade. On Stocktwits, retail sentiment around the USDC stablecoin issuer fell to ‘neutral’ from ‘bullish’ over the past day as chatter dipped to ‘low’ from ‘normal’ levels.

Coinbase, Strategy, MARA Extend Losses

Coinbase, one of the largest publicly listed crypto exchanges, extended its decline after hours alongside the largest corporate holder of Bitcoin and the biggest crypto miner in the market.

COIN’s stock was down 0.53% in overnight trade after falling 5.73% in the regular session. MSTR’s stock edged 0.09% lower following a drop of 5.21%. Meanwhile, MARA’s stock moved 0.13% lower after a drop of 1.31% in the regular session.

BlackRock Expands on Ethereum

BlackRock (BLK) announced on Wednesday that it is diving deeper into the Ethereum ecosystem. The asset manager said it was launching its BUIDL fund on Uniswap (UNI) and had purchased an undisclosed amount of UNI tokens.

BLK’s stock edged 0.10% higher in after-hours trading following a 0.45% decline in the regular session. Retail sentiment toward the world’s largest asset manager remained in ‘neutral’ territory, with chatter at ‘high’ levels on Stocktwits.

Meanwhile, UNI’s price defied the broader crypto downtrend, rising 40% before coming back down. UNI was trading at around $3.41 on Wednesday night, still up by 3.2% in the last 24 hours. According to analysts, the drawdown in UNI’s price is indicative of the larger bearish sentiment in the crypto market. Support is seen at $2.90. Holding that level could allow for further recovery, while a break below it may expose downside toward $2.09.

Read also: Tinder And Facebook On Blockchain? Cardano Founder Says That Will ‘Change Everything’

For updates and corrections, email newsroom[at]stocktwits[dot]com.<